The Bangladesh Bank introduced the Green Transformation Fund (GTF) fund in 2016 to provide finance for environment-friendly infrastructures in export-oriented industries, but factory owners in sectors other than textiles have shown little interest in borrowing from it.

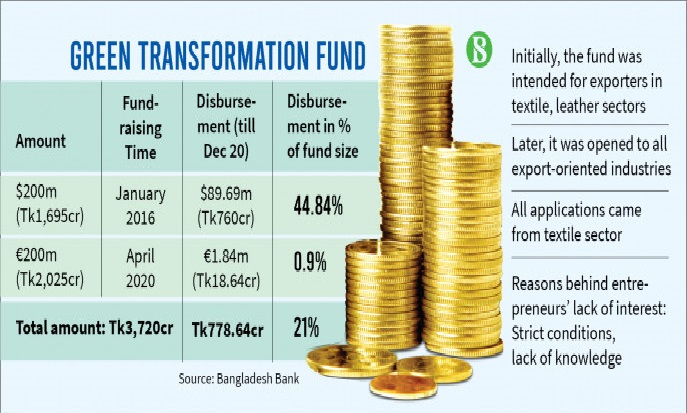

Loans disbursed from the Tk3,720 crore fund stood at only Tk778 crore as of December last year, which was 21% of the total fund size.

Entrepreneurs have said the stringent conditions set for obtaining loans from the fund as well as a lack of proper knowledge on the part of many of them about the fund are the major reasons why exporters have not been showing much interest in the loan.

Besides, many factory owners cannot apply for loans as they have already been declared loan defaulters by banks, they added.

The Bangladesh Bank established the fund in 2016 with $200 million from its foreign exchange reserves. At the current exchange rate of the US dollar, the figure stands at Tk1,695 crore.

It was initially announced that only exporters in the textile and leather sectors would get loans from the fund, but later it was opened to all types of export-oriented industries.

In April 2020, EUR200 million (approximately Tk2,025 crore) was added to the existing Green Transformation Fund of $200 million.

In the proposed budget for the forthcoming 2021-2022 fiscal year, Finance Minister AHM Mustafa Kamal mentioned that the fund was part of the government's ongoing endeavours to facilitate industrialisation in the country.

According to the latest report on green banking activities published by the central bank, from the $200 million portion of the fund, $89.69 million (around Tk760 crore) was released in loans against 20 applications till December last year.

On the other hand, from the other portion – EUR200 million – of the fund, EUR1.84 million (Tk18.64 crore) was disbursed against three applications as of December 2020.

Asked about this, an official of the central bank told The Business Standard that the latest figure of disbursements from the $200 million portion of the fund stands at $112 million, while that from the EUR200 million part stands at EUR4 million.

The official added that even though the fund offers low-interest loans, so far they have not received any application from any sector other than the textile sector. The central bank, however, is expecting loan applications especially from the leather and plastics sectors, he added.

He further added that at present there are 10 to 12 applications, but loan disbursements against these applications are being delayed as they have not been able to conduct field-level inspections due to the second wave of Covid-19 infections.

When asked why applications are not coming from the leather sector, sector insiders said many of them do not know about this fund. On the other hand, getting new bank loans is not possible for most entrepreneurs in this sector as they have already defaulted on loans, he further pointed out.

Speaking on this factor, Engineer Md Abu Taher, former chairman of the leather goods exporters' association, told The Business Standard that he did not know anything about the fund. "I think other people in this sector also do not know anything about it."

Shaheen Ahmed, president of the Tanners Association, however, said in spite of having knowledge about the fund, many of the leather sector traders will not be able to secure loans from the fund as they have turned defaulters while shifting tanneries from Hazaribagh to Savar. Besides, the conditions for getting a loan are also very complicated, he added.

Shakhawat Ullah, general secretary of the Tanners Association, alleged that banks do not help them get loans.

Jasim Uddin, president of Bangladesh Plastic Goods Manufacturers and Exporters Association and also the new president of the FBCCI, could not be reached for comment.

On loans taken out from the Green Transformation Fund, a 2% interest is added to the London Interbank Offered Rate (LIBOR). On the other hand, in the case of borrowing in euros, 1% interest is added to the Euribor – the average interbank interest rate at European banks.

Mohammad Ali Khokon, president of the Textile Mills Association, told The Business Standard that it is becoming easier for members of the association to set up environment-friendly factories as the interest rate on loans under the fund is low.

This business leader said one of the conditions for borrowing for the EUR200 million portion of the fund was to import machinery from Europe, which was a reason behind the low disbursement of loans in euro. Noting that the condition has now been relaxed, he said it would help to increase loan applications.

Loans are provided from the Green Transformation Fund for the import of ma