The novel coronavirus pandemic may be a game changer for digital payment systems in the country, which have remained much under-utilised for years despite innovations and massive leaps in technology.

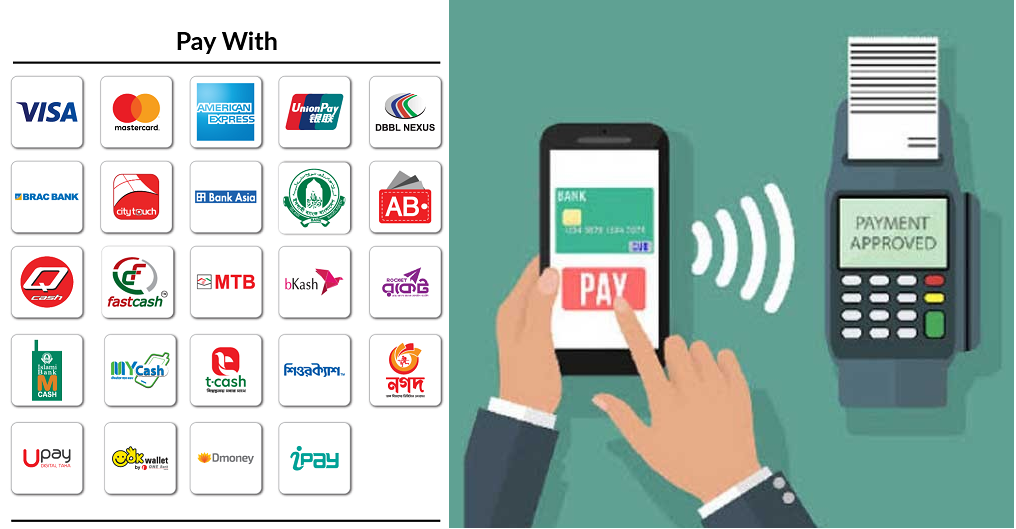

Now the use of digital payments – from electronic fund transfer to using cards or mobile banking to purchase groceries and pay utility bills – is growing increasingly popular in Bangladesh, albeit slowly.

Internet and app-based banking is gaining momentum faster than other digital systems, according to bankers. This success has encouraged other banks to launch apps by which a customer can make transactions on the go, using just a smartphone.

City Bank, one of the five first generation private banks of the country,introduced its digital banking appCity Touch seven years ago. With around 2.25 lakh customers, City is now the leader in internet banking.

Before the Covid-19 outbreak, the bank had seen transactions worth Tk550 crore on average in its internet banking channel per month. The figures shot up to nearly Tk750 crore in June this year.

Standard Chartered Bank, Eastern Bank (EBL), Brac Bank, Dutch-Bangla and Mutual Trust Bank (MTB) also witnessed a significant growth in internet banking in June compared to the pre-pandemic period.

EBL has witnessed more use of its app in the last three months than it has seen in three years. Online transactions of MTB increased by 30 percent in June, an improvement over the figures for April and May.

The Bangladesh Bank's data also reflect a rising trend in digital banking.

Available data show that in April, the volume of transactions through electronic fund transfer or EFT increased 80.43 percent to Tk28,417 crore from March.

The number of new debit cards rose by 77,664 from March to 1.98 crore in April despite the imposition of a lockdown to prevent the spread of Covid-19. The number of credit cards slightly rose to nearly 16 lakh.

Card based e-commerce transactions increased to Tk254 crore in April from Tk224 crore in the previous month.

Some 38,623 fresh customers availed internet banking services in April, bringing the total number of internet banking users to around 27lakh, according to central bank data.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said the bank was trying to upgrade technology-based operations so that people would not have to come to bank branches in person.

"Though banking was partially on from March 26 to May 31 due to the general holidays, the performance of and response to digital banking were really good," he said.

In April and May, people were afraid of going outside their homes, while businesses remained shut. As a result, card transactions in April fell by 50 percent from March. Point of sales(POS) transactions also declined by almost one-third to Tk454 crore in April from Tk1,438 crore a month earlier.

Card transactions, improving significantly in June, have remained in that state up until now, according to bankers.

"We had a higher use of cards in June compared to May. But half of July has already gone past the entire volume of transactions in June," said the head of the card division of a private bank.

Even so, such growth has not been able to satisfy many bankers.

"Our e-commerce transactions have grown by nearly 30 percent from the number before the pandemic. But my expectation was that it would double," said Abul Kashem Md Shirin, managing director of Dutch-Bangla Bank.

He said ATM transactions reached the pre-Covid-19 level of around Tk8,000 crore a month in June from Tk5,000 crore in April.

Shirin said the number of new debit cards did not increase as it was related to new bank accounts. Due to Covid-19 and lockdowns, the number of new accounts opened was minimal, he said.

Rahel Ahmed, managing director of Prime Bank, which recently launched a mobile app for banking, said that compared to the situation in the West, digital banking was still in its infancy in Bangladesh.

"Industry experts believe that digital banking is expected to take full flight in a few years with paperless, signature-less and even branchless banking. E-KYC, biometric identification, artificial intelligence and machine learning will expedite digital banking," Ahmed added.

Ahsan H Mansur, executive director of Policy Research Institute of Bangladesh, said though technology adoption was costly for banks, it could also reduce operating costs.

"All banks have to adopt and enhance digital services. The banks that cannot do it will drop out," he said.