A task force was set up 9 years ago to retrieve laundered funds from abroad consisting of 10 members. Recently Finance Ministry has formed another task force of 14 members for the same purpose.

Massive corruption in a number of sectors has overshadowed Bangladesh government's achievements. Corruption and irregularities are rising by leaps and bounds particularly on banking and financial turfs. Anti Corruption Commission (ACC) has stated that relevant agreements with different countries need to be signed immediately to retrieve laundered money.

Prominent citizens have commented that Bangladesh's economic prospects will be eclipsed if corruption cannot be resisted right now. ACC can only depend on Bangladesh Financial Intelligence Unit (BFIU) for information about cross-border crimes. Bangladesh has not yet signed any bilateral accords with most of the countries where most of the money is laundered from Bangladesh.

For this reason, the laundered money cannot be brought back from those countries. Bangladesh is not even connected with any international platform consisting of United Nations Office on Drugs and Crime (UNODC). That's why authorities in Bangladesh are not getting latest data about money laundering from Bangladesh to overseas destinations.

Money laundering from Bangladesh to foreign countries has increased on an unnaturally egregious scale, financial sources have informed. Reportedly 4 lakh 36 thousand crore taka have been illegally transferred from Bangladesh to overseas locations during last six years. On an average every year nearly 73 thousand crore taka is being laundered from Bangladesh to foreign destinations.

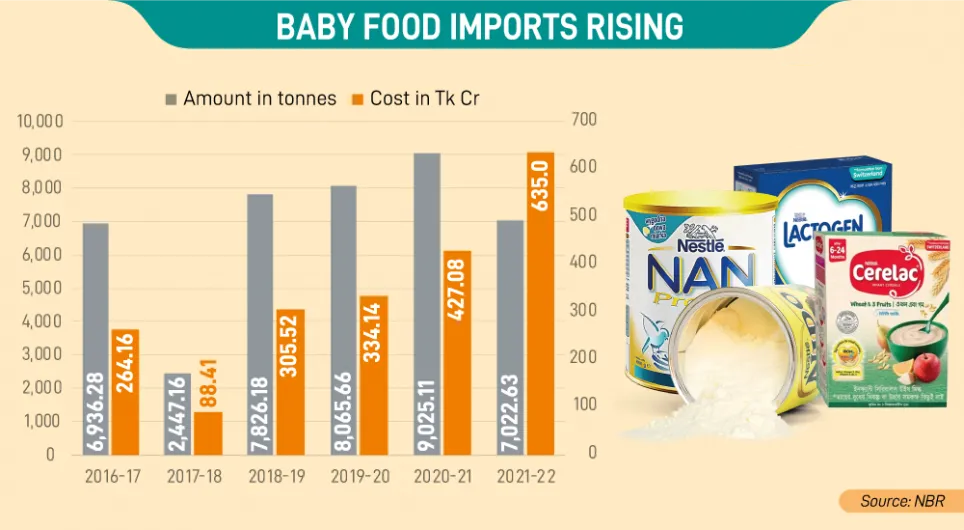

Bangladesh is now facing a trade deficit of 9.09 billion dollars which is the highest in the country's history.

Money laundering is one of the major reasons behind the burgeoning trade deficit in the country.

Financial experts have said that the list of the top money launderers of Bangladesh and the amounts they transferred abroad illegally should be exposed. At the same time required steps should be taken by Bangladesh government without delay to retrieve the laundered funds from overseas, economists have commented.

Bangladesh's banking sector is inflicted with over 2 trillion taka defaulted loans including written off debts, sources have reported. Economists have remarked that most of the defaulted loans might have been laundered to overseas locations.

Financial scholars have blamed extreme lack of good governance and accountability in the country's financial and banking sectors for the extensively rising figures of unlawfully transferred money from Bangladesh to foreign countries.

Financial experts have referred to political influence and inefficiency of Finance Ministry and Bangladesh Bank as principal causes behind money laundering. In recent times it has been exposed by relevant sources that a powerful group of money launderers are making false shipment papers and fake invoices to facilitate illegal money transfer from Bangladesh to overseas destinations.

Under-invoicing and over-invoicing are another two ways utilized by financial culprits for transferring money to foreign countries through unauthorized conduits. United Nations Conference on Trade and Development (UNCTAD) published a similar report in 2019.

Financial sources have said that Bangladesh became a member of Egmont Group headquartered in Canada in 2013 to exchange information about money laundering and terror finance. Egmont Group has 147 member countries. Bangladesh can seek cooperation from Egmont Group for bringing back laundered money.

Former adviser to caretaker government Dr. Wahid Uddin Mahmud said to The Asian Age, "These money laundering allegations should be investigated immediately. Finance ministry, National Board of Revenue and Bangladesh Bank can jointly conduct this scrutiny. Illegal money transfer cannot be stopped if stern actions against money launderers are not taken quickly."

Caretaker government's former adviser Dr. Hossain Zillur Rahman told The Asian Age, "The government should try hard to establish an investment-friendly atmosphere in the country to stop capital flight. Local entrepreneurs should be further encouraged to invest money at home."

Dr. Abul Barakat, President of Bangladesh Economics Association, said to The Asian Age, "Money laundering allegations should be investigated seriously to establish good governance in banking and financial sectors. Bangladesh Bank should clarify what steps have been taken to restrain money laundering."

Professor Anu Muhammad of Jahangirnagar University said, "Financial vices like money laundering threaten Bangladesh's economic foothold. Financial regulators have failed to take strong actions against money launderers and loan scammers."

Dr. Nazneen Ahmed, Senior Research Fellow of Bangladesh Institute of Development Studies (BIDS) said, "Money laundering and other financial graft and anomalies cannot be resisted without establishing good governance."

Dr. Iftekharuzzaman, Executive Director of Transparency International Bangladesh (TIB) said to The Asian Age, "Bangladesh is at present the second most corrupt country in South Asia according to the ranking by Transparency International. Corruption undermines the government's good jobs. Bangladesh government can resort to international money laundering laws for nabbing financial scammers. Besides, Bangladesh Bank, National Board of Revenue and Anti-Corruption Commission can take strong actions against the individuals who are committing such monetary rackets."