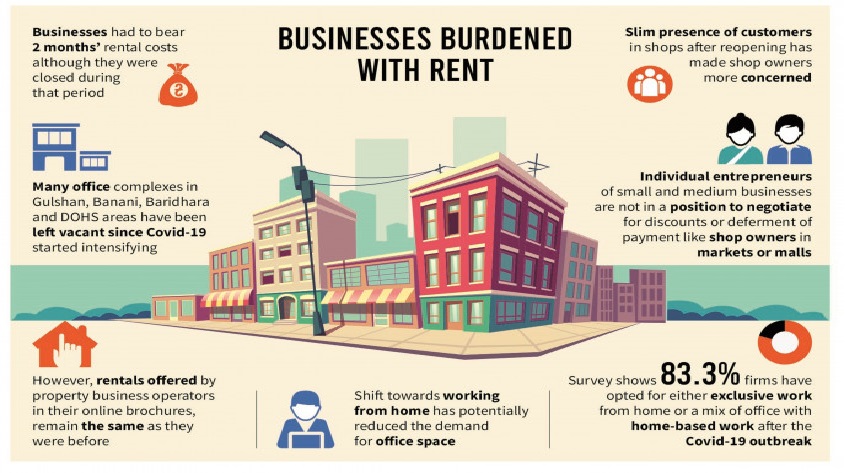

Working from home has potentially reduced the demand for office space and firms are renegotiating rents to reduce Covid-related losses

With income zeroing out, house rent surfaced as the crucial element among the main heads of businesses' expenditures during the 66-day closure amid a nationwide Covid-19 shutdown.

The amount was too large to bear for Mafruda Khan, owner of two beauty salons in the city. She had to shut one of the salons, and send 15 employees including 10 hairdressers and beauticians to furlough.

Rent accounts for one-third of her Tk20 lakh a month operating cost including wages.

As the due date for rent approaches, facing landlords is a stressful time for business owners in rented spaces in markets, alleys and streets of the city.

Be it a tiny barber's shop in a lane or a spacious shoe outlet in a shopping mall in the capital city, budgeting the rent has emerged as an equally vexing problem.

Rents for commercial spaces are three times higher or even more than that of residential houses in the Iqbal Road area of Mohammadpur where Mafruda's parlours are located.

"I used to pay Tk1,50,000 per month for a floor, while a whole five-storey building rented for a school costs Tk1,40,000," the business owner said.

Bearing the rent in regular time for a large space is very difficult, she said, and it has become unbearable during the pandemic.

Although businesses have started to reopen, most beauty parlours are still closed. A few, like the one run by Mafruda, are open on a limited scale but are seeing few footfalls as customers prefer to stay away for fear of contracting the coronavirus.

Shop owners in a market or mall are organised under an association and they can bargain for discounts or deferment. They also get support from trade bodies in renegotiating. But individual entrepreneurs of small and medium businesses are not in a position to renegotiate and Mafruda could not.

Bangladesh Shop Owners' Association President Mohammad Helal Uddin has to deal with "dozens of requests" every day from shop-owners for negotiating waiver or deferment of rental arrears and reduction in future rent with landlords.

The argument is the same for all sizes of businesses: how to pay rents since they were shut for two months.

"Every day, I am sitting with shop owners and landlords and trying to help them settle the disputes mutually," he said.

In most cases, landlords have relented and agreed on a deal like reducing half rental for April and May, and deferring the payment.

Helal's association was the first in deciding to keep less-essential shops shuttered even before the government decreed shutdown from March 26.

Since then, economic activities had been on a pause and businesses other than medicine and grocery shops remained shut until partial reopening from June 1.

"Rent must come down. Cost of rent is huge in business," says Mamun Rashid, managing partner of PwC Bangladesh.

He finds commercial space in Dhaka to be more expensive than in Mumbai, India's financial capital.

Foreign corporates prefer Gulshan, Banani, Baridhara and DOHS areas for office complexes, and many of those have been left vacant for long since the Covid-19 started intensifying globally early this year.

But rentals, offered by property business operators in their online brochures, remain the same as they were three months back.

Real estate business operator Bproperty offers office and shopping spaces at rates ranging from Tk350 to Tk500 per square feet in the capital's Gulshan and Banani areas. "The rates have not come down. However, there might be some discounts during the negotiations," a commercial executive of the firm said.

Home office appeared as a new normal amid the pandemic, and while being welcomed by employees, it has given corporate offices a chance to review their expenses for spaces and cut those. Mamun cited some examples how PwC, which gives professional services to help businesses thrive, is now also showing the corporates the way to reduce need and cost of office spaces.

The examples are supported by research findings of Economic Research Group (ERG), that show: restricted movement and the fear of getting infected forced many to adapt to new institutional culture -- 83.3% firms opted for either exclusive work from home or a mix of office with home-based work.

The survey of 102 firms, headquartered mostly in Dhaka and Chattogram, reveals that other than a single ISP, all IT firms work either exclusively from home or mix work at office and home.

Around 30% of the firms are joint-ventures and foreign owned.

With service sectors accounting for more than 50% of GDP, Bangladesh is perhaps ready to undertake a major move towards establishing a culture of home-based work. Such coping mechanisms will help reduce Covid-related losses, says the mid-May survey.

Shift towards working from home has potentially reduced the demand for office space and many firms are found to have engaged i