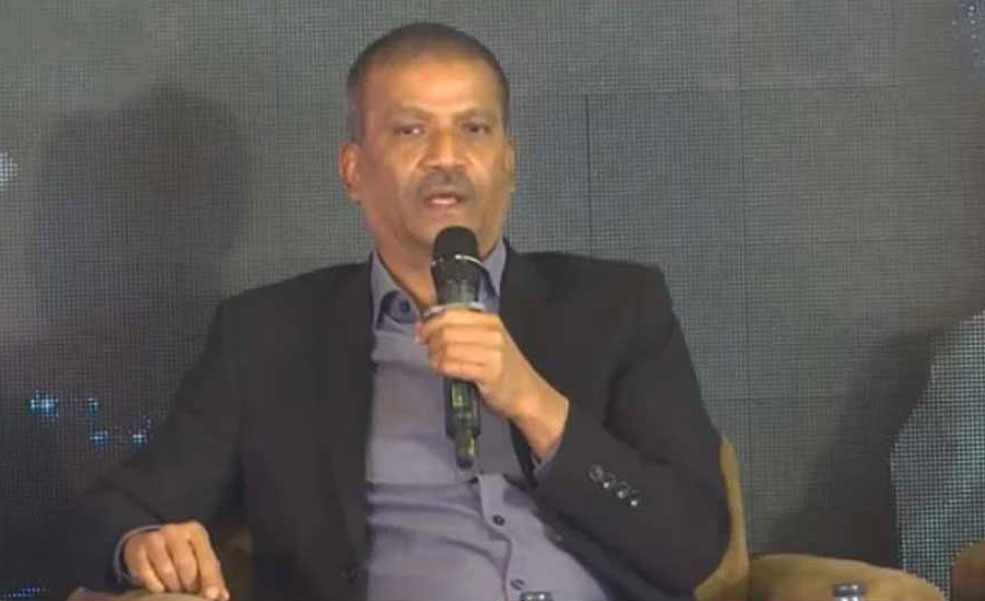

The country’s banking sector will recover from the Covid-19 shock after September this year, state-run Janata Bank Managing Director Abdus Salam Azad has said.

“The entire economy is under pressure as industrial production has been hampered due to Covid-19 outbreak, which has affected the banking sector. But it will be back on the track after September this year,” Abdus Salam Azad said in an interview with the Daily Sun.

“We are working relentlessly in the face of the Covid-19 outbreak. Bankers are working at risk to implement the incentive packages announced by the government and within September the bailouts measures will be fully implemented,” he expressed hope.

“The way we have taken steps [to implement the incentive programmes] will turn the entire banking sector around after next September.”

“I think the economy will be fully operational soon, and there is no reason to be worried,” the Janata Bank MD said.

Veteran banker Abdus Salam has led many successful disbursement and collection of loans in his long banking career. Despite the crisis, Janata Bank's profits have increased during his time.

Despite the coronavirus situation, Janata Bank has continued its operations fully from the very beginning of the crisis, though banking services were very limited at some point of the crisis.

He said the time has come that the banking sector goes beyond the conventional approach. “Many are concerned about the ongoing crisis in the entire banking sector. But I think there is nothing to worry about. It is not yet time to assess the damage that has done by the epidemic.”

“However, the way things are going, the banking sector does not have to take much loss. We are lending to new sectors. Special facilities have been provided for entrepreneurs. The economy will get in the right motion soon.”

“Bangladesh Bank has already provided a lot of policy support. Some entrepreneurs should still be given benefits by regularizing defaulted loans. Many entrepreneurs have kept their production afloat in this crisis”

He said many entrepreneurs could not repay their loans regularly due to the cancellation of export orders. They are now unable to go into new production as can’t have new funds for being defaulters.

“I think there is something for them to do. For that, the BRPD Circular-15 of 2012 should be amended. It will be possible to make new investments by regularizing the loans of many industrial entrepreneurs. In addition to our debt distribution, we have also increased the amount of recovery despite the crisis,” Abdus Salam said.

“I was fortunate enough to take part in the country’s liberation war. The way we fought against the Pakistanis, we will also win against the current crisis.”

The government has announced a special fund of Tk 75,000 crore for the industrial sector, Tk 30,000 crore for the SME sector and Tk 5,000 crore for the agricultural sector. The bailout packages are being implemented through all banks.

“There are many more proposals in the RMG sector for special benefits. If these are implemented, the whole economy will become active. There is no shortage of power and gas during this crisis. The supply of fuel is also normal. So it will not take long for everything to be normal,” Abdus Salam said.

However, the banking sector will not be as profitable as before. It would be wrong to think so. But if the economy is active, the banking sector will also be active. Production, export trade is slowly being resumed. There is no reason to be apprehensive, he opined.

He said Janata Bank has been offering online banking services by connecting directly to 911 branches across the country.

“We are working by giving importance to health safety for all. At Janata Bank, 60 people were infected with coronavirus and three died. But we did not lock down any branch. We are working tirelessly to implement the incentive package announced by the Prime Minister,” Abdus Salam said.