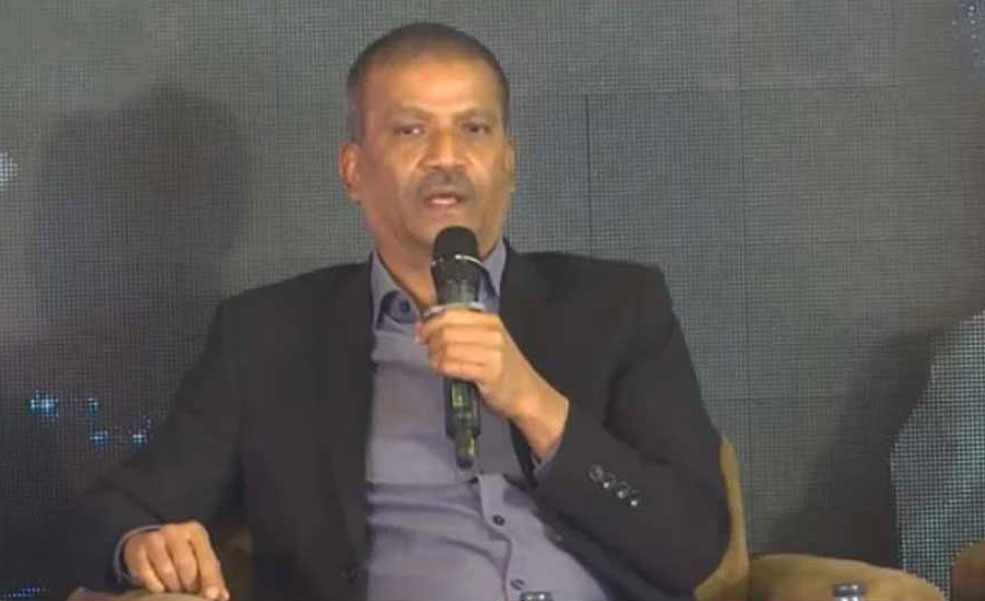

NBR Chairman Abu Hena Md Rahmatul Muneem presiding over a pre-budget meeting with a delegation of MCCI, Dhaka led by its President Nihad Kabir at the conference room of the NBR in the city on Tuesday

The Metropolitan Chamber of Commerce and Industry (MCCI), Dhaka, on Tuesday alleged withholding taxes were denying the corporate taxpayers the benefits of the cut in their tax rate, made effective in the budget for the current financial year (FY).

In the budget for the fiscal year (FY) 2020-21, the government reduced the corporate tax from 35 per cent to 32.5 per cent.

The chamber body alleged that the effective rate of corporate tax went up to 50-60 per cent in some cases, as the businesses had to pay taxes at import stage, during production, and also for finished products.

"Higher effective rate of corporate tax is affecting local as well as foreign investment in the country," said MCCI President Nihad Kabir, in a pre-budget meeting with the National Board of Revenue (NBR) on the day.

While presenting the trade-body's budget proposals for the FY 2021-22, Ms Kabir also demanded of the government to rationalise withholding taxes for businesses to bring down the effective corporate tax rate.

NBR Chairman Abu Hena Md Rahmatul Muneem chaired the pre-budget meeting on the NBR premises.

Adeeb H Khan, the MCCI's taxation subcommittee chairman, said it was difficult to give a straight answer to the investors on what was the corporate tax rate in Bangladesh, as actual tax burden was higher than what is found in the budget document.

The MCCI president, in this regard, opined that the corporate tax rates should be brought down in phases to help the country better prepared to face the Least Developed Country (LDC) graduation in 2026.

"It's true that the economy has rebounded from Covid-19 pandemic shocks; but income of people is yet to reach the pre-Covid level, which may become normal by June-July."

She also proposed imposing tax on land sales on the basis of market value instead of 'ad valorem' method to check accumulation of black money.

Currently, land registration fee is being determined area-wise, which is much lower than that of the market prices, Ms Kabir noted.

A certain amount of legal income of a land seller became illegal or black as s/he had to show prices as per the government's fixed rates.

She also proposed to reinstate the provision of 'appeal' instead of 'revision' for the tax-related disputes, and not to incentivise the taxmen for higher collection of taxes, as it fuelled harassment.

The MCCI president urged the NBR to gear up the process of Alternative Dispute Resolution (ADR) system for dispute settlement. Around 2,500 cases related to customs matters remained pending in the court now for settlement.

While presenting the MCCI's income tax-related proposals, Mr Adeeb Khan suggested cutting down the advance income tax on import, supply chain and service supply.

He also proposed not to impose a limit on promotional expenses, whose allowable limit was up to 0.5 per cent of the business turnover, as it affected the Fast-Moving Consumer Goods (FMCG) companies.

However, the NBR chairman favoured the provision, saying that the allowable limit was not too low, and it was required for protecting the consumers' interest by checking low-quality sub-standard goods in the market.

Mr Khan also proposed allowing aggrieved taxpayers to give a bank guarantee instead of depositing 25 per cent of the disputed amount prior to going to the tribunal.

The MCCI urged the NBR to implement the original VAT law framed in 2012, as the current one is confusing and difficult as it happened in the case of the previous VAT law framed in 1991.

"The existing VAT law is beyond the fundamental principles of VAT that has reinstated the worst provisions of the previous VAT law, such as price declaration."

Mr Khan proposed to waive the provision of obtaining 'input-output coefficient' declaration from the businesses, as it was a form of price declaration of the VAT law 1991.

Most of the VAT-related litigations centred on the price declaration system in the previous law, as there were scopes of bargaining with the VAT officials on declared prices.

The MCCI also alleged that the central VAT registration system for the businesses has become a complex one, while scopes of input tax rebate had shrunk in the new VAT law.

Actual VAT rate went up beyond 15 per cent due to scrapping input tax rebates for many items.

Adeeb H Khan also proposed to reduce the withholding tax on non-resident foreign experts to 10 per cent from 20 per cent.

The NBR chairman said acceptance of the budget proposals on fiscal measures depended on the situation prevailing in the country.

He, however, appreciated the detailed budget proposals of the MCCI.