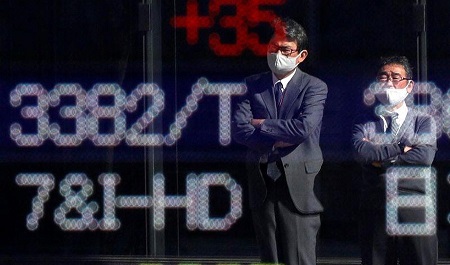

Asian shares climbed on Monday, with a broad regional index touching a record high on hopes for imminent coronavirus vaccines, but worries over the impact of economic lockdowns and uncertainty over US stimulus capped gains.

A top official of the US government’s vaccine development effort said Sunday that the first vaccines could be given to US healthcare workers and others recommended by mid-December.

Despite the grim backdrop of accelerating Covid-19 infections in the United States, the forecast helped to raise hopes that lockdowns that have paralysed the global economy could be nearing an end.

“With the vaccine on its way and the likelihood that economic damage being done by the virus will lift, we’ll still have in place substantial support from central banks and governments. And that is an economic sweet spot that should see a significant economic bounce,” said Michael McCarthy, chief market strategist at CMC Markets in Sydney.

“It’s fascinating that investors are willing to focus on that aspect. It does require some pretty heavy squinting, including looking through the rising infection rates that we’re seeing right now. But there is a real optimism around it.”

Total US Covid-19 cases topped 12 million over the weekend and more than 255,000 have died.

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.56 per cent on Monday, pushing past a previous record high touched on Friday.

Seoul’s Kospi was 1.82 per cent higher as an optimistic earnings outlook for South Korean chip giants drove gains.

Japanese markets were closed for a holiday, but Nikkei futures added 0.19 per cent to 25,795.

The regional index also got a boost from Australian shares which gained 0.51 per cent as the country eased some Covid-19 restrictions. Most of the country has seen no new community infections or deaths in several weeks.

Chinese blue-chips added 0.69 per cent. Hong Kong’s Hang Seng was an outlier, edging down 0.2 per cent.

While most regional indices were up on Monday, sentiment was fragile as monetary and fiscal help for the US economy remained elusive.

US Treasury Secretary Steven Mnuchin said on Thursday that key pandemic lending programmes at the Federal Reserve would expire on December 31, putting the outgoing Trump administration at odds with the central bank and potentially adding stress to the economy.

“Discussion is only beginning and may take some time if the recent partisan disagreements over the composition and magnitude of fiscal spending are any indication,” analysts at ANZ said in a note.

US e-mini futures for the S&P 500 were 0.26 per cent higher at 3,563 on Monday after US shares slumped on Friday on a combination of dwindling aid for the US economy and rising novel coronavirus infection rates.

The Dow Jones Industrial Average dropped 0.75 per cent, the S&P 500 fell 0.68% and the Nasdaq Composite ended down 0.42 per cent.

In currency markets, a rise in the safe-haven yen underscored nagging investor concerns. The dollar softened 0.1 per cent to 103.75 while the euro gained 0.14 per cent on the day to $1.1870.

The dollar index, which tracks the greenback against a basket of six major rivals, nudged down to 92.255.

US crude eased less than 0.1 per cent to $42.40 per barrel and global benchmark Brent crude rose 0.18 per cent to $45.04 per barrel.

Spot gold added 0.06 per cent to $1,871.69 per ounce.