Banks have been receiving a huge number of applications from pandemic-hit industries and businesses seeking loans from the stimulus packages

Slow loan distribution by banks from the government stimulus packages to cushion the impact of the coronavirus on the economy, has left the Bangladesh Bank frustrated, prompting it to issue an order to disburse all the funds by the end of next month.

After the Covid-19 pandemic unfolded in Bangladesh, the government announced 19 stimulus packages totaling up to Tk103,117 crore, equivalent to almost 3.5% of the country’s gross domestic product (GDP).

Banks have been receiving a huge number of applications from pandemic-hit industries and businesses seeking loans from the stimulus packages. However, the central bank thinks the financial institutions have failed to meet the expected pace of credit disbursement, according to a senior official of Bangladesh Bank.

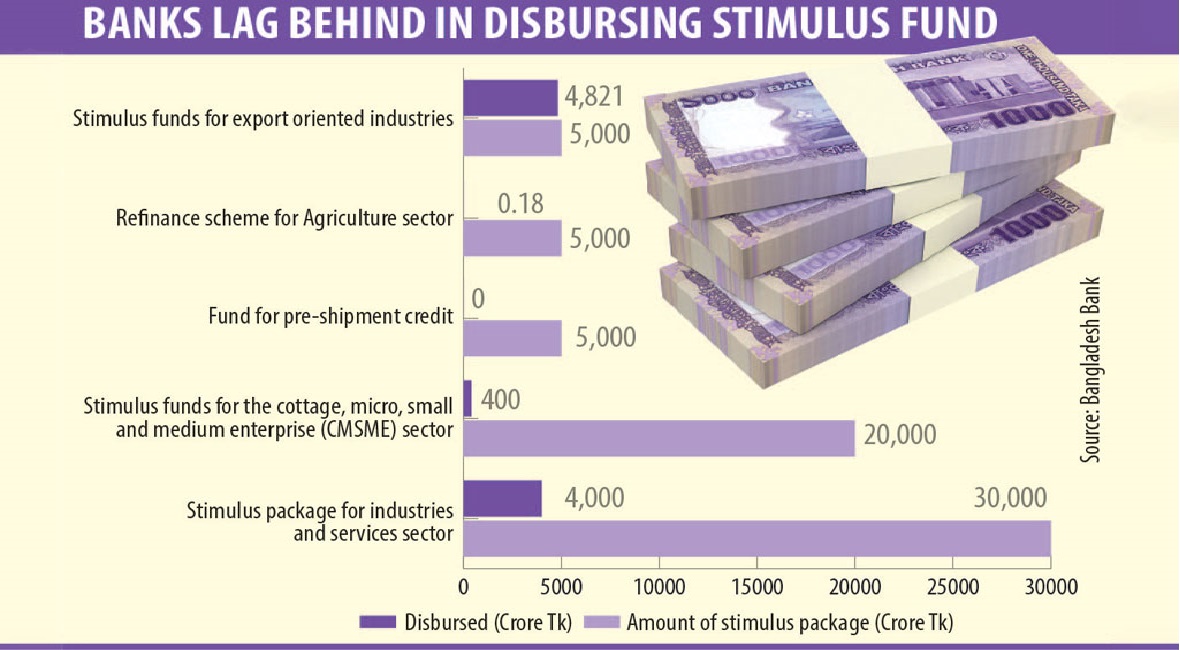

Out of the 19 packages, five worth Tk65,000 crore, are being implemented through the banks. This includes stimulus for export-oriented and other industries like the service sector, SMEs, agriculture, and refinancing for pre-shipment credits.

Only the Tk5,000 crore stimulus package for export sectors have been fully disbursed until now. Irked by the slow lending, the Bangladesh Bank on Thursday told commercial banks to complete disbursing the loans by the end of August 2020.

Commercial banks said that the verification process of clients seeking loans was the reason for the slow disbursement.

“We are disbursing loans from the stimulus fund after strong verification because many of the clients applying for loans have not repaid their previous loans,” a managing director of a private bank told Dhaka Tribune, but asked not to be named.

Export sectors

Soon after the pandemic unfolded, the government, on March 25, announced Tk5,000 crore in stimulus for exporters, which they were able to access with only a 2% service charge.

The Bangladesh Bank was set to release the funds as salaries for workers and employees of export-oriented factories through equal instalments in the three months from April to June. However, nearly the entire fund —Tk4,821 crore — was disbursed in just two months.

As many as 1,992 export-oriented firms borrowed the funds in April and May through 47 banks. The central bank has requested the government for additional funds in a bid to clear wages for June.

Industries and services sector

In line with the government’s instructions, the central bank launched a Tk30,000 crore stimulus package, which would allow banks to give an interest subsidy of 4.5% on disbursed loans given to end-users at 9% interest on the books.

Bangladesh Bank later launched a refinance scheme of Tk15,000 crore for banks to disburse the fund as part of the government’s stimulus package.

As of July 2, Bangladesh Bank approved around Tk4,000 crore in loan proposals of banks to 300 firms under the stimulus scheme for the industries and services sector hit by the coronavirus outbreak.

Cottage, micro, small and medium enterprise (CMSME) sector

On April 13, the central bank issued guidelines for providing working capital facilities from the Tk20,000 crore package to small businesses affected by the pandemic, setting an interest rate ceiling of 9%.

It later formed a Tk10,000 crore revolving refinancing scheme to help implement the Tk20,000 crore stimulus package.

As of July 4, seven commercial banks — state-owned and private — have disbursed only Tk400 crore in loans. They are, Agrani Bank, Bangladesh Krishi bank, Islami Bank Bangladesh, Shahjalal Islami Bank, Mercantile Bank, Trust Bank and the City Bank.

“We have already disbursed Tk200 crore in loans to the SMEs and a huge number of loan applications are now being processed,” Islami Bank Deputy Managing Director Abu Reza Mohd. Yeahia told Dhaka Tribune.

Refinance scheme for agriculture sector

On April 14, Bangladesh Bank launched the Tk5,000-crore special refinance scheme for the country’s agricultural sector with 4% interest rate.

The only bank requesting funds from the central bank under the scheme is NRB Commercial Bank, which sought Tk18 lakh in May.

Pre-shipment credit

On April 13, Bangladesh Bank issued a Tk5000 crore refinancing scheme for export-oriented industries as pre-shipment credit. However, it’s yet to release any funds under the scheme till now.

Businesses have also come down hard on banks alleging that some of them are reluctant to distribute loans from the stimulus packages.

In a media call on June 27, FBCCI President Sheikh Fazle Fahim called the government to withdraw its deposits from those banks and increase the amounts of money for banks that are cooperating with the businesses.

South Asian countries, including Bangladesh, might lose somewhere between