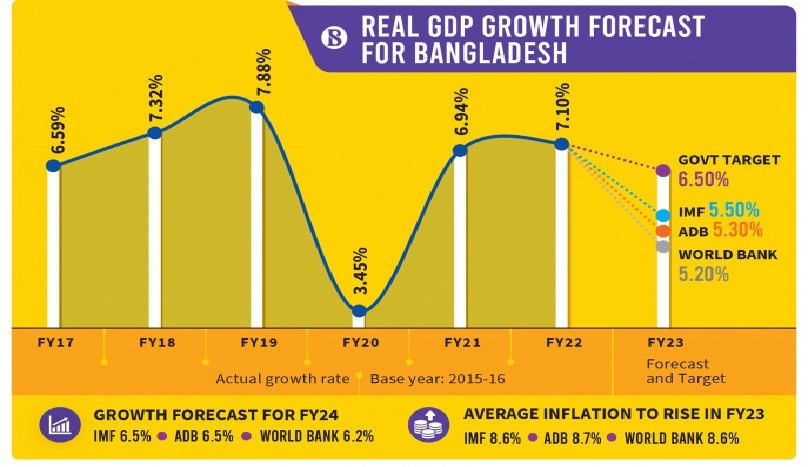

The International Monetary Fund has kept Bangladesh's gross domestic product growth forecast for the current fiscal year (FY23) unchanged at 5.5%, lower than the government's target of 6.5%.

Yet, Bangladesh is expected to remain one of the fastest-growing economies globally, with only seven countries projected to grow at a higher rate, the global lender says in its latest outlook.

Earlier in January this year, the IMF set Bangladesh's growth forecast at 5.5%.

The IMF's projection is slightly higher than that of the World Bank and the Asian Development Bank, which predicted 5.2% and 5.3% growth respectively for Bangladesh in the current fiscal.

In the latest version of its World Economic Outlook released on Tuesday, the IMF said Bangladesh's GDP will grow at 6.5% in the next fiscal (FY24).

The Washington-based lending agency forecasts inflation may stand at 8.6% for the current fiscal year, down from its January projection at 8.9%. It expects Bangladesh's inflation to cool down to 6.5% next fiscal year.

The IMF has cut its GDP growth forecast for India for FY 2023-24 by 20 basis points to 5.9%, which is lower than the Reserve Bank of India's projection of 6.4%.

China's growth has been revised upward to 5.2% this year from 3% last year. Overall, emerging and developing Asia's growth is projected to be at 5.3% this year.

It has revised its global growth forecast, projecting a bottoming out at 2.8% this year, before a modest increase to 3% next year - 0.1 percentage point below its previous projections in January.

In its latest report, the IMF warns that downside risks in the banking instability and sticky inflation keep the global outlook fragile.

Advanced economies, particularly the euro area and the United Kingdom, are experiencing an economic slowdown this year with expected growth rates of 0.8% and -0.3% respectively, according to the IMF projections. However, both regions are projected to rebound next year with growth rates of 1.4% and 1% respectively.

On the other hand, despite a 0.5 percentage point downward revision, many emerging markets and developing economies are picking up pace, it says. These economies are expected to accelerate from 2.8% growth in 2022 to 4.5% in 2023.

Despite a slower-than-initially-anticipated reduction in global inflation, which fell from 8.7% last year to 7% this year, and is expected to fall to 4.9% in 2024, the IMF maintains that the world economy's gradual recovery from the Covid-19 pandemic and Russia's invasion of Ukraine is on track.

According to the IMF's latest World Economic Outlook report, China's reopened economy is rebounding strongly, while supply chain disruptions are unwinding and energy and food markets are recovering from dislocations caused by the war. In addition, the significant and synchronised tightening of monetary policy by most central banks should begin to bear fruit, leading to inflation moving back towards targets.

Fog around the world economic outlook thickens

In its latest report, the IMF warns that the world economic outlook remains fragile, with downside risks in the banking instability. The situation is compounded by inflation, which is much stickier than anticipated, despite a decline in global inflation.

Core inflation, which excludes energy and food prices, has not yet peaked in many countries, with a significant upward revision of 0.6 percentage points from January, and well above target. Despite the ongoing tightening cycle, economic activity shows signs of resilience, with strong labour markets in most advanced economies.

This may call for monetary policy to tighten further or stay tighter for longer than currently anticipated, it feels.

The report indicates that real wages should increase, but corporate margins have surged in recent years, which may delay the process. The IMF believes that as long as inflation expectations remain well-anchored, the risk of an uncontrolled wage-price spiral is low, although it may take longer than anticipated.

According to the IMF, monetary policymakers should focus on bringing down inflation while being prepared to adjust quickly to any financial developments and avoid any financial instability, since the global economic outlook remains fragile.

Tighter fiscal policy could support monetary policy by cooling off economic activity, allowing real interest rates to return to a low natural level, it suggests, calling for proper oversight and management of market strains to prevent financial fragilities from turning into a full-blown crisis.

Access to the Global Financial Safety Net, including the IMF's precautionary arrangements, access to the US Federal Reserve Foreign and International Monetary Authorities repo facility, or to central bank swap lines, where relevant, are essential for emerging markets and developing economies, it says.