Instead of investing more in different financial schemes in the country, non-resident Bangladeshis (NRB) are now more interested in withdrawing their capital by selling investment bonds and stock market shares, data shows.

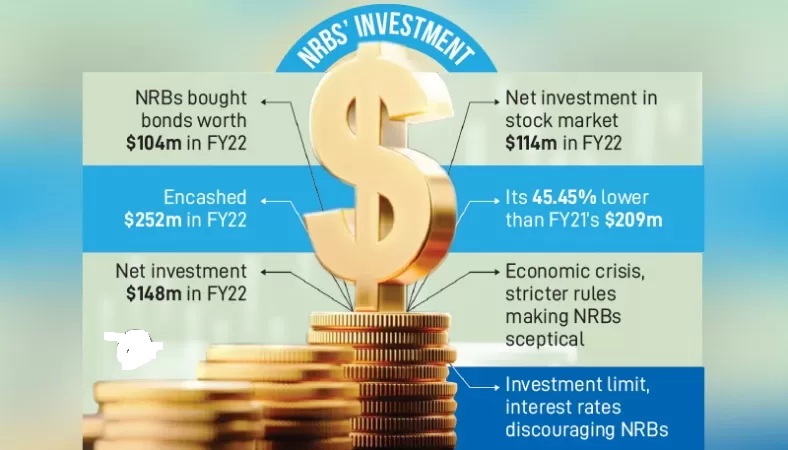

In FY2021-22, NRBs had invested $104 million in USD bonds, but they withdrew their investments by selling investment bonds worth $252 million, according to Bangladesh Bank (BB) data.

That means the net investment in USD bonds was at a negative $148 million in the last financial year.

Meanwhile, the NRBs’ investment trend in the capital markets is decreasing as well. Five years ago, their annual investment in the capital markets was $179 million. It was $114 million in FY22.

Experts have said that the expatriates are withdrawing past investments and not showing interest to invest further because of the global economic crisis, increasing number of default loans in the country, lack of good governance in the financial sector, rising inflation, no increase in interest rates, and new stricter rules on investing in different financial schemes.

Centre for Non-Resident Bangladeshis Chairperson Shekil Chowdhury told The Business Post that many are losing interest due to the investment limit for expatriates in bonds.

In 2021, the government set a limit of Tk 1 crore for aggregate investment in bonds for expatriates.

“Moreover, the current mismanagement in the financial sector is scaring the NRBs. As a result, they are apprehensive about their investments. Due to the weakness in enforcing the laws, the expatriates are also fearful about the security of their property in the country. Their investment is decreasing due to these reasons,” he said.

Talking to The Business Post, former BB governor Dr Salehuddin Ahmed said, “NRBs are losing interest in investing in the existing financial schemes because their returns are very low. It is not good for the country’s economy.”

Requesting anonymity, a senior BB official said there are attractive bond facilities in the country for the NRBs to invest in, but not many of them are doing it. “We recently found out that a certain number of expatriates are investing and taking advantage of these facilities.

“The government wants to attract more NRBs to invest in these bonds and that’s why it fixed the amount of investment in conventional bonds by an expatriate,” said the official.

Going negative

In 2021, the government set a limit of Tk 1 crore for aggregate investment in bonds for expatriates.

To tackle the impact of continuously increasing dollar exchange rates and encourage expatriates to invest, the government earlier this year lifted the limit and withdrew the mandatory condition of submitting a copy of the national identity card for investing in US Dollar Premium Bond (UDPB) and US Dollar Investment Bond (UDIB).

However, the move fell on its face. In FY22, expatriates withdrew $12.55 million against an investment of $1.60 million in UDPBs — leaving net investment at negative $10.95 million, according to BB.

In the case of UDIBs, NRBs invested $10.77 million but withdrew their investment by selling bonds worth $103.57 million, leaving the net investment at a negative $92.8 million.

Also, they withdrew $135.69 million against an investment of $91.72 million in the Wage-Earner Development Bond (WEDB), leaving the net investment at a negative $43.97 million.

However, in the last five years, NRBs have sold bonds for $511.65 million after investing $985.5 million, which left the net investment at $473.85 million.

The five-year WEDB was launched in 1981 to inspire expatriates to invest here. The UDPB and UDIB, both three-year terms, were launched in 2002.

Currently, the interest rates for WEDB, UDPB and UDIB are 12 per cent, 7.5 per cent and 6.5 per cent, respectively.

More problems

Speaking on the issue, Ahsan H Mansur, executive director of Policy Research Institute (PRI) said, “USD bonds have been very popular among expatriates since they were introduced. But NRBs are now withdrawing investments because of the government’s stubborn decisions.”

“The ongoing economic crisis is a minor reason behind the investment decline, but the major one is curbing the investment limit.

“Although the government has lifted the limit, many expatriates still do not know about it due to the lack of a publicity campaign. The NRBs need to be informed about this amid the dollar crisis,” he added. Meanwhile, expatriates have also reduced investment in the capital markets. Their net investment in FY22 was $114 million, which is 45.45 per cent lower than $209 million in FY21, according to BB.

In FY20, expatriates’ net investment was $191 million; $224 million in FY2018-19; $279 million in FY2017-18; and $179 million in FY2016-17. That means the expatriates’ net investment in the capital markets was about $2 billion in the last five fiscal years.

“I think investment [in stock markets] will keep falling since expatriates and foreigners invest in Bangladesh’s capital markets when the foreign interest rate is low and the markets are bearish,” said Mansur, also the executive director of Policy Research Institute of Bangladesh.

“With the US Federal Reserve and the Bank of England raising interest rates, the number of dollars coming into our capital markets will fall. The NRBs will increase investment again when the interest rate will drop and the markets will be on a downward trend — which means shares will become relatively cheaper,” he added.

However, this will take at least one or two years to happen, he observed.