Global Islami Bank Limited, a newly listed fourth-generation bank, witnessed an 18.4 per cent decline in net profit in the first nine months (January-September) of 2022, thanks to a high provisioning against loans and advances.

The Islamic Shariah-based bank’s provisions soared by 164 per cent year-on-year in January-September this year.

The high provisioning might affect its future profitability as well, according to an equity note prepared by EBL Securities Ltd, a stockbroker, amidst the ongoing macroeconomic hardships and the rising nonperforming loan (NPL) ratio in the country’s banking sector.

Moreover, the bank’s shares failed to lure investors in an already dampened capital market.

On Wednesday, the bank’s stocks closed at Tk 9 per share which was 10 per cent lower than its face value of Tk 10 each on its trading debut at the Dhaka Stock Exchange (DSE).

This was a very unusual incident in the country’s capital market as shares usually gain prices in the initial trading days after their debuts.

With the initial public offering (IPO), the company raised a fund worth Tk 425 crore from the capital market under the fixed price method.

To raise the fund, the bank offloaded 42.5 crore ordinary shares at a face value of Tk 10 each.

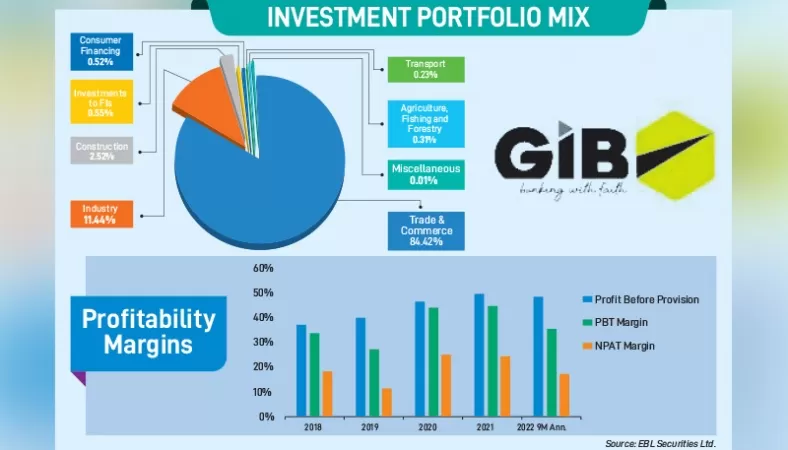

The Shariah-compliant bank would utilise the fund by investing in SME businesses, government securities, and the stock market, as well as meeting the IPO expenses.

According to the unaudited financial statements, the bank posted Tk 34 crore in net profit in January-September 2022 against Tk 48.36 crore in the same period last year.

Its basic earnings per share (EPS) stood at Tk 0.66 for January-September this year from Tk 0.94 for the same period last year.

The post-IPO basic EPS for July-September 2022, however, would be Tk 0.36.

Furthermore, its profit after tax stood Tk 80.73 crore with a basic EPS of Tk 1.57 for the nine months ending in September 2022.

The bank’s profit before keeping the provision hit Tk 26.83 crore in 2021, which was Tk 19 crore in 2020.

According to the study, the figure would be Tk 30.22 crore by the end of 2022.

Global Islami Bank, formerly known as NRB Global Bank, is an entirely Islamic Shariah-based financial institution commencing operations in 2013.

The newly listed bank has a paid-up capital of Tk 940 crore. LankaBangla Investments and Prime Bank Investment were the issue managers for the IPO proceeds.

The cost of funds of the fourth-generation bank was higher than those of many other conventional banks, squeezing its profitability amidst high inflationary pressures and the lending rate being capped at 9 per cent, EBL Securities noted.

Global Islami Bank has the 11th lowest paid-up capital among the 34 listed banks, and its sponsors and directors own 45.7 per cent of its post-IPO shares which would be locked-in for the next three years.

Furthermore, the company’s shares got the lowest subscription in recent times.

Since the interest spread of the bank has been increasing since 2020, the net investment margin (NIM) has increased from 3.39 per cent in 2020 to 5.06 per cent in 2022 (9M annualised). However, its interest rate spread was lower than the industry average of 3.03 per cent, according to the EBL Securities study.

Global Islami Bank was taxed at a 40 per cent rate prior to listing and would benefit from a lower tax rate of 37.5 percent after listing, the EBL Securities study read.