The Dhaka bourse scaled new heights yesterday, crossing 7,000 points as buoyant investors increased their bets in hopes that the market would maintain its upward trend in the coming days.

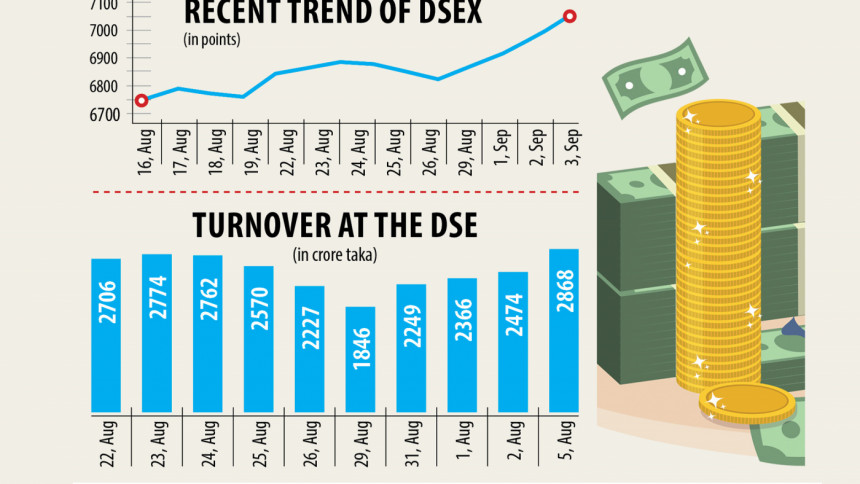

The DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), surged 71 points, or 1.02 per cent, to close at 7,052. This is the highest level the index has reached since its inception in 2013.

The DS-30, the blue-chip index, rose 37 points to 2,533.

"Due to lower interest rates in the banking sector, many savers have chosen the stock market to keep their funds to ensure a sizeable profit," said a top official of a merchant bank.

The banking sector has enforced a maximum 6 per cent deposit rate and 9 per cent lending rate from April 1, 2020. As a result, savings at banks are carrying a negative return if inflation is taken into account.

The government has also lowered the ceiling for investments in the national savings instruments, leaving the investors with only one option: the stock market.

"So, the market has been on an upward trend for the last few months," said the merchant banker, adding that investors were more confident.

The DSEX has surged 75 per cent since the pandemic arrived on the shores of Bangladesh in March last year.

In fact, stock markets worldwide have been climbing new heights, powered by mass coronavirus vaccination and rebounding economies.

In the US, the S&P 500, the broad market index, set a new record high last week. The Nasdaq Composite traded up 0.90 per cent for its own all-time high 15,265.89, reported CNBC.

The benchmark indices in Indian markets closed at a fresh record on Friday.

Md Moniruzzaman, managing director of IDLC Investments Ltd, said the market rallied thanks to the new leadership team at the Bangladesh Securities and Exchange Commission (BSEC) and its steps to improve governance.

Easy money at a lower interest rate in the money market, additional liquidity injection by the central bank, and the government's proactive role to support the economy through various schemes helped the market, he said.

Turnover, an important indicator of the market, reached Tk 2,868 crore from Tk 2,474 crore a day earlier, up about 16 per cent.

On the DSE, 208 stocks advanced, 130 fell, and 37 remained unchanged.

"Investors hope that the market will soar further, so they are pouring in their money," said a market analyst, adding that the key index has risen almost every day in the last few months.

Low paid-up capital-based and low-performing companies were hot cakes in the last few months, said Sharif Anwar Hossain, president of the DSE Broker's Association.

"These stocks have become riskier. In fact, the stock market is always risky. But people make profits within such a reality. So, analysis is necessary."

Still, there were many high-performing companies whose stocks were underpriced, he said. "The market is not overvalued, but some stocks are overvalued."

Bangladesh Monospool Paper and Packaging topped the gainers' list, rising 10 per cent, followed by ADN Telecom, Apex Spinning, Samata Leather, and Paper Processing and Packaging.

SEML FBLSL Growth Fund shed the most, losing 9.84 per cent, followed by SEML Lecture Mutual Fund, SEML IBBL Shariah Fund and Fareast Islami Life Insurance.

Stocks of Beximco Limited traded the most, worth Tk 183 crore, followed by LafargeHolcim Bangladesh, Beximco Pharmaceuticals, LankaBangla Finance, and Doreen Power.

The Chittagong Stock Exchange also rose yesterday as the CASPI, the general index of the bourse in the port city, edged up 234 points, or 1.15 per cent, to 20,563.

Among the 327 stocks traded, 198 rose, 100 fell, and 28 remained unchanged.