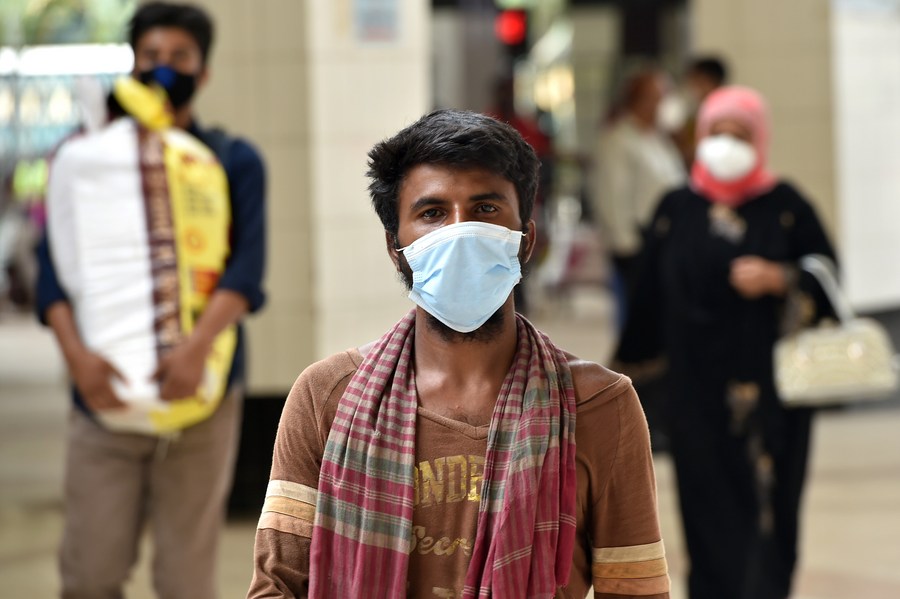

The troubles keep piling up for India, feted not long ago as a would-be commercial superpower. Economic data show the country is in far worse shape than previously thought, while it has overtaken Mexico to become the world's third-largest tally of coronavirus cases. It will take the South Asian giant years, at least, to dig out from this hole.

The country reported Monday its worst slump since quarterly numbers began publication in 1996: Gross domestic product shrank 23.9% in April to June compared with a year earlier. Conditions were tough even before the virus erupted because of a banking crisis that hobbled growth in 2019.

Plenty of places have been pummeled by the pandemic, though few have notched a descent as steep. And unlike Malaysia, Singapore or China, the shutdown in India didn't curtail the spread of the virus. The country is now vying with Brazil for second-place behind the US with the most cases. Infections numbered more than 3.62 million as of Monday and there have been 64,469 deaths. (The population is 1.3 billion.) India paid the economic price without the public health dividend.

The policy paralysis, then, is especially unfortunate. After leading Asia in interest-rate cuts last year, the Reserve Bank of India has shifted to a slower gear. Officials are hamstrung by inflation that persistently runs above the central bank's 4% target (with a buffer of 2% on either side). The cocktail of frustration and fatalism running through minutes of the central bank's most recent meeting is understandable: India is one of the few emerging markets where consumer price increases are above pre-pandemic levels, according to Oxford Economics. That's largely thanks to a jump in vegetable prices.

The logjam needs to be broken, nevertheless. Lower borrowing costs won't speed the arrival of a vaccine or suppress cases, but they can alleviate conditions and help put a floor under confidence. The Federal Reserve's more relaxed view of inflation ought to give the RBI some leeway, as I wrote here.

Policy makers who argued successfully to hold rates last month pointed to the stickiness of food prices and the potential for those increases to flow through to the broader economy. They might be on to something. Agriculture was one of the few areas of the economy to shine last quarter, adding 3.4% to GDP. Manufacturing, which Prime Minister Narendra Modi, has tried to nurture, slumped almost 40%. That figure exceeded 50% for construction. The financial sector, which is the biggest component of services, declined 5.3%.

These are staggering numbers, even in a world where the roll calls for recession have become numbing. The case for greater fiscal stimulus almost makes itself, except that the government is bumping up against its own constraints. Separate figures Monday showed that Modi breached his full fiscal-year deficit target after just four months. Something needs to give. New rules allowing banks more room to buy and hold government debt will go some way toward absorbing the extra financing needed to buttress the economy. The RBI has also been conducting a Fed-style "Operation Twist" program since December, where the bank buys long-term debt while selling shorter-maturity securities.

But something far bigger may be warranted, and Indonesia's recent debt monetization shouldn't escape Modi's attention. I wrote in July that by avoiding extreme censure by investors, Jakarta may encourage other emerging markets to test this approach. India does have a history of monetary stunners; one evening in late 2016, Modi announced without warning that he was withdrawing most banknotes from circulation. Direct funding of the deficit would pale by comparison.

The pandemic may have hit everyone, but it couldn't have come at a worse time for India. This is the second wake up call in as many years, after the credit crunch of 2019. Is this the moment when critical momentum was lost?

The World Bank alluded to this in its Global Economic Prospects report, published in June. For developing economies, "the exceptional severity of the pandemic and economic collapse raises concerns about the risk of 'super-hysteresis': not only a permanent loss of output levels but a permanent slowdown in potential output growth." The foundation upon which the emerging-market boom of the past few decades has been built is under threat, it said.

There's still room for India to claim the century as its own; a lot can happen in 80 years. The government wants you to believe that a V-shaped recovery is in the works. For the time being, I would settle for a call between New Delhi and Jakarta.