Revenue collection: Govt going to get a grip on VAT

Businesses having turnover more than Tk50 lakh are coming under an automated value added tax (VAT) payment system from Tuesday, which will enhance government's revenue collection by stopping evasion.

The National Board of Revenue (NBR) Chairman Abu Hena Md Rahmatul Muneem will inaugurate a project on installation of electronic fiscal devices (EFDs) at businesses on Tuesday.

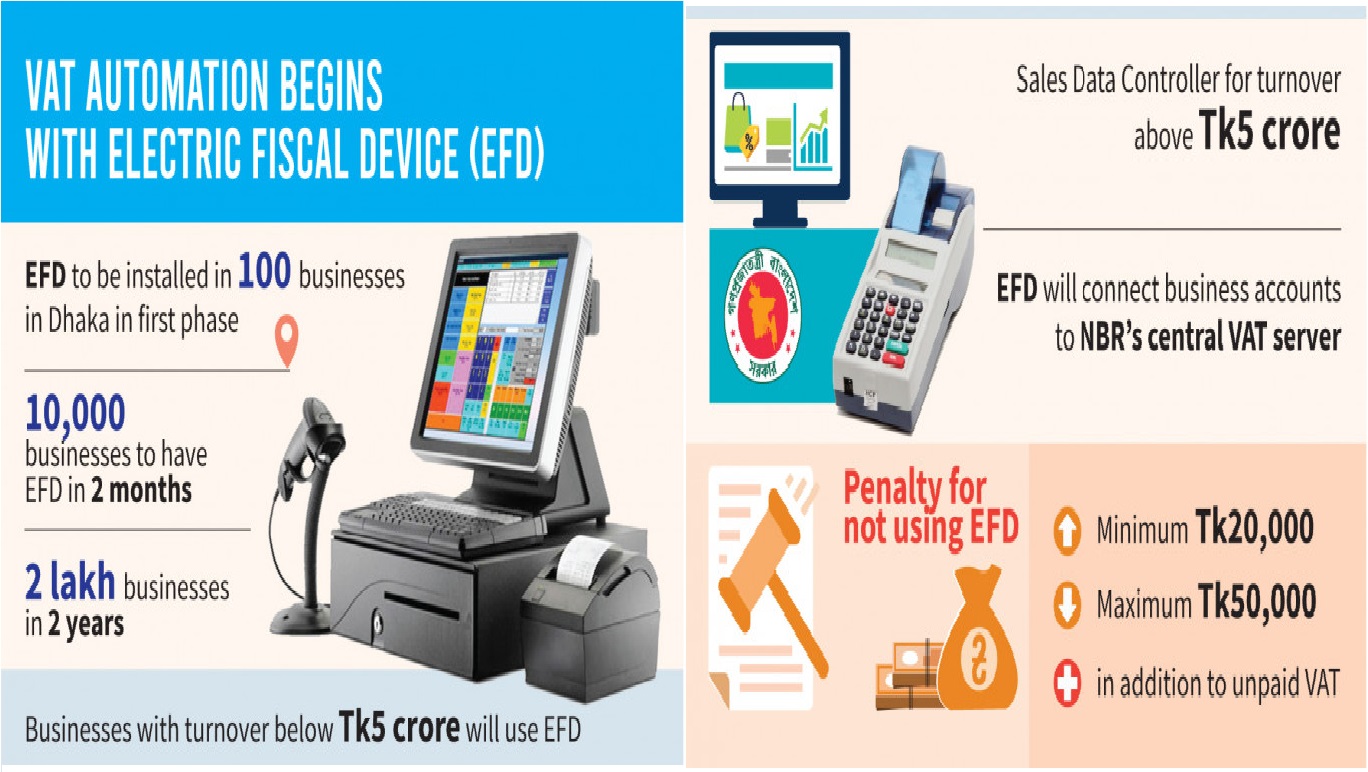

In the first phase, all electronically stored accounts of businesses will be linked to the NBR's central VAT online project through installing EFDs in100 businesses in the capital.

As a result, the tax authorities will automatically be aware of the sales figures of these businesses.

In the next two months, the device will be installed in 10,000 more businesses whose turnover is between Tk50 lakh and Tk5 crore per annum.

The NBR will provide the software to businesses by importing it through using the government budget.

Automatic accounting has been made mandatory in 24 types of businesses, including residential hotels, restaurants, fast food stores, sweet stores, beauty parlours, readymade garment shops and department stores.

On the other hand, if the turnover is more than Tk5 crore per annum, businesses themselves will have to install Sales Data Controller (SDC) software. The NBR will initiate this process very soon.

Kazi Mostafizur Rahman, director of NBR's VAT online project, told The Business Standard, "Once you put an entry in the device, the NBR will know about it. Businesses will no longer be able to hide sales information. After collecting VAT from consumers, they will be forced to deposit it in the government treasury."

The NBR said EFDs will be installed in businesses under its own supervision. The device will be installed in at least two lakh businesses within the next two years.

The government had initially decided to supply EFDs to businesses at the purchase price. The NBR received an allocation of Tk107 crore in the 2019-20 fiscal year in this regard.

An international tender was invited in December 2018 to buy one lakh EFDs in five years. The company which won the project has to insert the software in the devices and will also be responsible for software management for five years.

The overall VAT system, including purchase of EFDs and software development, is going online as part of the NBR's VAT online project.

With the help of the World Bank, the project, worth Tk690 crore, was taken up in 2013. It is expected to be completed in December this year.

On the other hand, the procurement committee of the cabinet has recently approved the purchase order of a project worth Tk320 crore to give EFDs to traders in installments and software at low cost.

What are SDC and EFD?

The SDC is a solution to prevent tax evasion on cash registers, point of sale systems and other invoicing systems. It stores sales and tax information.

An EFD is a device similar to SDC. It is used in place of an electronic cash register. It can store sales information.

An EFD is cheaper than an SDC. Besides, there is no maintenance cost.

How SDCs and EFDs work

NBR officials said these devices will be connected to the central VAT server. A business identification number (BIN) will be given to every business against every software and device.

The BIN will be the same even if multiple EFDs are used by a business. However, the NBR will provide a special code for each device.

As a result, when an EFD is activated, NBR officials in different customs excise and VAT commissionerates will be able to come in touch with information regarding that business.

Who will use the device?

The number of members of Bangladesh Shop Owners Association is 30 lakh. In addition, there are at least another 10 lakh shops in operation.

The NBR said at least 20 percent of the 40 lakh stores meet the conditions for using this software and device. As a result, five to six lakh devices have to be supplied.

Penalties for not using the device

According to the NBR, if the device is mandatory for a business but it does not comply with regulations, it will be penalised under Section 37 of the VAT Act.

If proved that it did not comply, the business will have to pay a fine amounting to a minimum of Tk20,000 and maximum of Tk50,000 in addition to unpaid VAT.

Reaction of traders

The Federation of Bangladesh Chambers of Commerce and Industries, the apex body of traders, thinks that the use of EFDs and SDCs is good for businesses.

FBCCI Vice-President Siddiqur Rahman said, "We want the NBR to use its capacity to bring about transparency in business. In that case, evasion by all parties will stop."

According to the new VAT law which came into force on July 1, all VAT activities are to be conducted online.

As part of this process, the initiative was taken to install software to control the turnover of businesses.

Editor & Publisher: S. M. Mesbah Uddin

Published by the Editor from House-45,

Road-3, Section-12, Pallabi, Mirpur

Dhaka-1216, Bangladesh

Call: +01713180024 & 0167 538 3357

News & Commercial Office :

Phone: 096 9612 7234 & 096 1175 5298

e-mail: financialpostbd@gmail.com

HAC & Marketing (Advertisement)

Call: 01616 521 297

e-mail: tdfpad@gmail.com