Digital loan...Bangladesh enters a new era

The Covid-19 pandemic has ironically brought about a revolution in digital banking as banks are quickly adopting technology-based products, thereby allowing customers to access banking services from home.

Digital loan is one such product that will give customers a first-time experience in the country of processing loans through their bKash app, reflecting how technology has been taking over the banking industry.

City Bank has launched "Digital Loan" product on a pilot basis, collaborating with bKash, the largest mobile financial service provider in the country. This will enable customers to access financing from their handsets.

It is a collateral-free digital loan product, whereby users can request and receive loans of up to Tk10,000 instantly through bKash. The loan disbursement will be scaled up gradually through the mobile app.

bKash developed the app through using the technology engine of its investment partner, which will assess loan proposals under the project.

City Bank has launched this pilot initiative with the approval of the Bangladesh Bank, and aims to expand access to finance to an unbanked population and so contribute to the journey of financial inclusion.

Upon successful completion of the project, City Bank will commercially launch the Digital Loan product for eligible bKash users, subject to approval from the Bangladesh Bank for a commercial launch.

Ant Financial will be the technology partner undertaking credit assessment of potential borrowers for this project. It is an affiliate of the world's leading technology conglomerate Alibaba Group, and offers advanced AI-based credit assessment facilities for digital loans offered in various countries, including China, India and the Philippines.

City Bank came up with the product at a time when the banking sector experienced a huge response in digital transactions from customers in the pandemic situation.

In April, the volume of transactions through electronic fund transfer (EFT) increased by 80.43 percent to Tk28,417 crore from March.

The number of new debit cards rose by 77,664 from March to 1.98 crore in April despite the imposition of a lockdown to prevent the spread of Covid-19. The number of credit cards slightly rose to nearly 16 lakh.

Card-based e-commerce transactions increased to Tk254 crore in April from Tk224 crore in the previous month.

Some 38,623 fresh customers availed internet banking services in April, bringing the total number of internet banking users to around 27lakh, according to data from the central bank.

"Many people in our country, especially small traders, often need money for emergency purposes, and this app-based digital loan will deliver money urgently," said Mashrur Arefin, managing director of City Bank.

"Through the experience we will gain from this pilot initiative and with continuous improvement, we will be able to provide even better services to customers in the future," he said.

Kamal Quadir, CEO of bKash, said, "The Digital Loan project of City Bank exemplifies how banks can come up with new and creative services to improve the lives of the common people. It broadens the scope of financial inclusion by using bKash's platform and leveraging our robust customer base."

"We believe this collateral-free, instant digital loan will bring about a transformative impact on marginalised people, micro entrepreneurs and students through helping them to meet their emergency personal or business needs."

How Digital Loan app will function

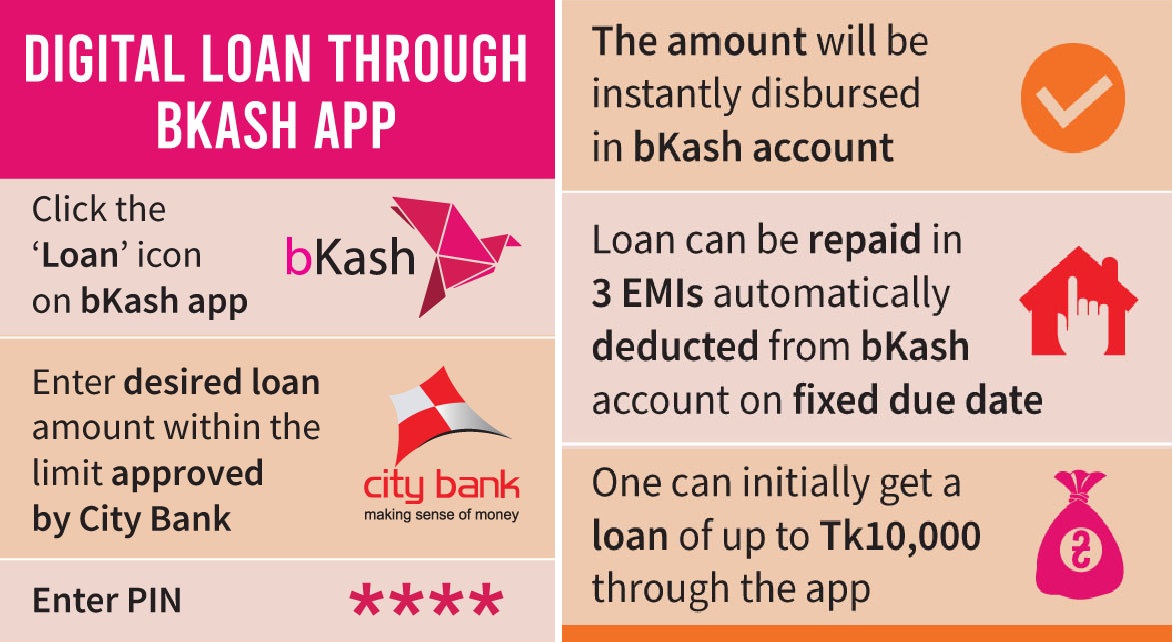

Under the pilot initiative, bKash users can request a loan from City Bank from the bKash App, receive the loan disbursement in their bKash accounts as well as repay the loan from the accounts.

To avail the loan under the pilot initiative, eligible users will need to click the "Loan" icon on the bKash app and enter the desired loan amount within the loan limit approved by City Bank, as well as accept the terms and conditions of the loan.

Users will also have to give consent to sharing their "know your customer" (KYC) information, available in bKash, with City Bank before availing the digital loan.

Once the bKash PIN is successfully entered, the loan amount will be instantly disbursed in the user's bKash account. The interest rate as well as loan terms and conditions applied by City Bank are in accordance with the guidelines of the Bangladesh Bank.

City Bank's Digital Loan in the pilot phase has a three-month term, and loan repayment involves three equal monthly instalments (EMI) automatically deducted from the user's bKash account on the fixed due dates.

The user will also be able to repay the EMI amount earlier than the due date, and save money due to lower interest cost associated with early repayment.

Interest on digital loans is charged on a daily basis. Therefore, in case of early settlement, users will repay interest based

Editor & Publisher: S. M. Mesbah Uddin

Published by the Editor from House-45,

Road-3, Section-12, Pallabi, Mirpur

Dhaka-1216, Bangladesh

Call: +01713180024 & 0167 538 3357

News & Commercial Office :

Phone: 096 9612 7234 & 096 1175 5298

e-mail: financialpostbd@gmail.com

HAC & Marketing (Advertisement)

Call: 01616 521 297

e-mail: tdfpad@gmail.com