BD export earnings drop 17pc in FY20

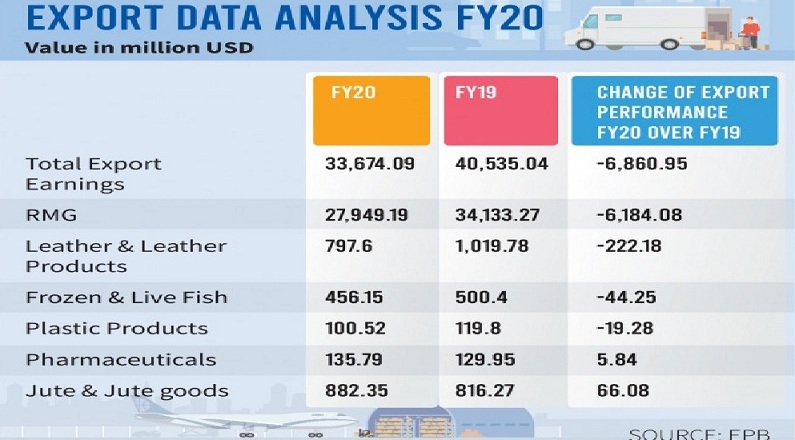

The country's export earnings fell by 16.93 percent to $33.67 billion in the just-concluded fiscal year 2019-20.

The drop was a result of the impact of coronavirus during last quarter.

The country fetched $40.53 billion in fiscal year 2018-19.

Economists and exporters are hopeful about overcoming the crisis, but said it would require diversifying products and markets.

It also depends on the improvement of Covid-19 situation across the export destinations, they said.

Apparel export is coming back to the right track as June figures showed, and it is good news for all, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh (PRI).

"We need to see if this trend sustains. If this continues in the next few months, we will be able to be out of the woods," he said.

Ahsan said the apparel sector requires lots of changes that the industry people know very well.

"They should produce manmade fibre-based products and sustainable apparels instead of fast fashion clothes."

The manmade fibre industry needs a big investment and we should attract foreign direct investment in this sector as such investment comes with technology and know-hows, said Ahsan.

He said exporters may focus on Asian countries that have big markets.

"China alone imports apparels worth billions of dollars. We have a chance to increase the share there."

"Japan, India, Singapore, Indonesia, Malaysia, Thailand and the Philippines can be good export destinations for Bangladeshi apparels," he added.

Shahidullah Azim, former vice-president of the Bangladesh Garment Manufacturers and Exporters Association, said many big retailers have closed their stores and filed for bankruptcy, which will affect the overall business.

"We must go to another market where we have the opportunity to export more. China could be a big apparel market for Bangladesh," he said.

Azim said export to China needs shorter lead time, which will give exporters the opportunity to increase export to $3 billion within a year.

Making products according to the market demand is required to achieve that goal, he said.

"We do not know how long the pandemic will continue. The future of the country's export earnings depends on that," said Kutubuddin Ahmed, chairman of Envoy Group.

He said the overall demand for apparels will decline as people will not buy fashion items during the pandemic. "They will spend money on food and other necessary items first."

Buyers are now creating pressure to reduce product prices and suppliers are also trying to run their business without any hope to make profits, said Kutubuddin.

He said every government has provided policy support for their industries, and the Bangladesh government has also done so.

"We need to make a mega plan for the export sector, which will also be helpful to reduce job cuts more."

In June 2020, export earnings stood at $2.71 billion, showing a 2.50 percent decline compared to the corresponding month of the previous fiscal year, according to the Export Promotion Bureau, Bangladesh.

Readymade garment exports – Bangladesh's major earner – declined by 18.12 percent to $27.94 billion in FY2019-20, which was $34.13 billion in the previous fiscal year.

Leather and leather product exports fell by 21.79 percent to $797.6 million in FY20, which was $1.01 billion in FY19.

However, non-leather footwear export earnings enjoyed a 2.06 percent growth, reaching $277.13million.

Jute, once known as the golden fibre, and jute goods have recorded an 8.10 percent growth to $882.35 million, which was 7.08 percent more than the target of $816.27 million.

Agricultural product exports declined by 5.16 percent to $862 million. However, tea, vegetables, tobacco, and fruit exports have registered positive growth.

The pharmaceutical sector fetched $135.79 million, with a 4.49 percent growth.

Frozen and live fish exports fell by 8.84 percent to $456.15 million, which was $500.40 million in the previous fiscal year.

Editor & Publisher: S. M. Mesbah Uddin

Published by the Editor from House-45,

Road-3, Section-12, Pallabi, Mirpur

Dhaka-1216, Bangladesh

Call: +01713180024 & 0167 538 3357

News & Commercial Office :

Phone: 096 9612 7234 & 096 1175 5298

e-mail: financialpostbd@gmail.com

HAC & Marketing (Advertisement)

Call: 01616 521 297

e-mail: tdfpad@gmail.com