Why Bangladesh is fully dependent on imports

Bangladesh has become totally dependent on imported baby foods as no local companies produce them due to a lack of policy support, investment and necessary infrastructures in the country.

The import dependency is also not reducing as local entrepreneurs are somewhat reluctant to invest in the sector to produce baby foods locally.

The annual demand for baby foods is around 12,000 tonnes in the country but no local production has given international brands the scope to dominate the market without any competition.

Industry insiders said that despite huge milk production in the country, no company is producing baby foods due to the absence of initiatives, required investment and support to build the food-making infrastructure.

At present, Bangladesh is meeting 83 per cent demand for milk through local production and the country is on the track to becoming self-sufficient in milk production very soon.

However, there is still a lack of broad planning to ensure the proper use of milk and produce diversified dairy products including baby foods by processing the milk.

Baby food market

Bangladesh has seen significant growth within the baby product industry in recent years due to rising incomes across emerging markets.

In addition, with changes in parental attitudes towards child nurture and healthcare issues, there has been increased interest from consumers in premium baby products.

The baby food market size in Bangladesh now amounts to Tk 4,000 crore while the yearly demand for baby food is around 10,000-12,000 tonnes, according to industry insiders.

The market is growing even though the country is number one in breastfeeding. In Bangladesh, 65 per cent of women exclusively breastfeed their babies up until the babies are five-six months old, the highest in the world.

Sector insiders said that the increasing purchasing capacity of the people, the increased number of working mothers in every sector and an aggressive marketing policy of the companies have contributed to the significant rise in the market.

Import on the rise

Since baby foods are not produced locally, Bangladesh needs to import huge amounts of them to meet local demands.

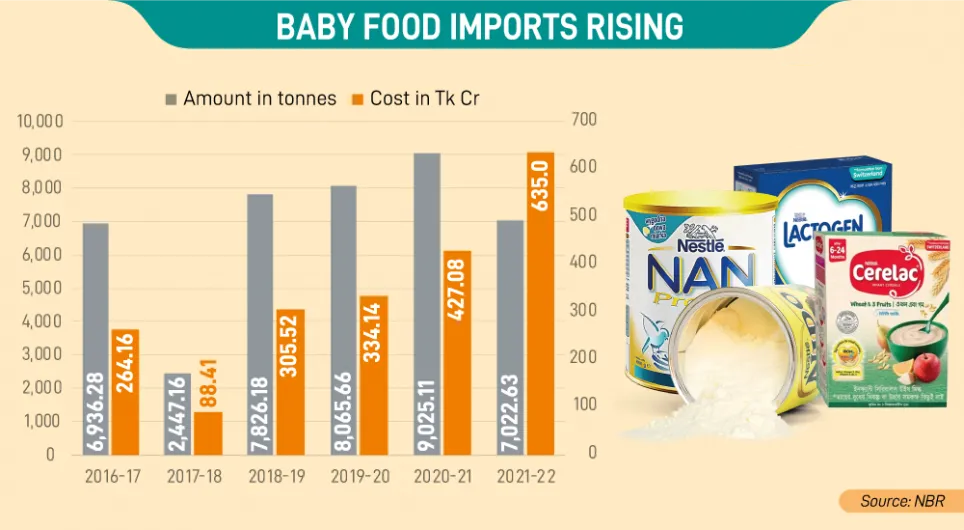

According to National Board of Revenue (NBR) data, the import of baby foods is increasing every year. The country imported 7,022.63 tonnes of baby foods worth Tk 635 crore in FY2021-22, which is lower than the previous years because of the Covid-19 pandemic related restrictions.

Before, Bangladesh imported 9,025.11 tonnes of baby food worth Tk 427.08 crore in FY2020-21; around 8,065.66 tonnes valued at Tk 334.14 crore in FY2019-20; around 7,826.18 tonnes worth Tk 305.52 crore in FY2018-19; 2,447.16 tonnes at Tk 88.41 crore in FY2017-18; and 6,936.28 tonnes worth Tk 264.16 crore in FY2016-17, showed the data.

Why locals reluctant to produce baby foods

Prof Dr Nazma Shaheen, of Dhaka University’s Institute of Nutrition and Food Science, told The Business Post, “Our key focus has been on food production to eradicate hunger but now we should give attention to ensuring nutrition alongside quality food.”

“I think there is a lack of government policy regarding local production of baby food items in Bangladesh. Our food producers companies are also not investing and giving enough priority to produce baby foods,” she said.

Prof Nazma said, “It seems to me that the local companies are not going to invest in production as producing baby food is highly sensitive. There are also foreign competitors in the market.”

The local companies are giving more attention to import instead of production as there is the scope for quick business, she added.

Sector insiders said there is a need for broad planning and immediate implementation by the government for the development of the dairy sector and producing baby food locally.

They said the government should discuss with dairy farmers, traders, collectors, processors, government bodies and NGOs concerned and take initiatives in this regard.

Seeking anonymity, an official of Nestle Bangladesh Ltd told The Business Post that fresh liquid milk is scarce in Bangladesh and it is not enough to set up a factory, which is an obstacle for investors.

“Unsuitable infrastructure and the unfriendly atmosphere also create hindrances to further expansion of the baby food industry here,” the official said.

The official said that the country must make a long-term preparation to create a congenial atmosphere with policy support to the dairy farms for resolving the liquid milk crisis.

“As we do not have vast meadows for catering livestock like New Zealand and Australia, we have to increase our milk production using the limited land,” the official added.

Bangladesh Dairy Farmers’ Association (BDFA) General Secretary Shah Emran told The Business Post that the milk sector saw revolutionary growth in recent years but they still cannot produce baby foods due to a lack of investment and infrastructure.

He said, not only baby foods, but Bangladesh is also importing huge amounts of powder milk due to a lack of powder milk-making infrastructure.

Emran said there are a good number of processors, who only pasteurise milk but they are not giving attention to producing baby foods. All baby food brands available in the market are imported as the local companies producing dairy products cannot make those due to a lack of initiative, policy, investment and infrastructure.

He urged the government and private sector to invest here as there is a huge demand for baby foods and the country is losing huge currency by importing.

Bangladesh Milk Producers Cooperative Union Limited (Milk Vita) Chairman Sheikh Nadir Hossain Lipu told The Business Post, “If the government gives necessary support, Milk Vita can produce the baby foods ensuring proper nutrition maintaining quality.”

He also said that manufacturing baby food is a very sophisticated task because collecting raw materials and processing them will have to be done very carefully and only Milk Vita has such capacity.

The dominating brands

Nestle Bangladesh is currently dominating the baby food industry in Bangladesh with more than 50 per cent of the market share. Nestle have a filling, processing and packaging plant in the country.

Over the past two decades, Nestle Bangladesh has been offering diverse baby food items for people of all levels. It is famous for CERELAC, LACTOGEN (1, 2, 3, 4 and RECOVER), NESTLÉ NIDO (FORTIGROW, 1+, 3+), and NAN (1, 2, AL110 and PRENAN).

Abul Khair Group’s imported key baby food brands include Mother’s Smile and some cereal items. They have also MARKS Active School and MARKS Active School 2 in 1 in the baby food items category.

Meanwhile, Dano, the country’s most loved milk powder brand for 60 years, has been available in Bangladesh since 1961. Its portfolio currently includes Dano Power, Dano Growth Shakti, and Dano Daily Pushti.

It is the local subsidiary of the Danish multinational dairy cooperative Arla Foods. Primarily imported through local partners, Arla Foods Bangladesh Ltd has been operating in Bangladesh since 2014.

Moreover, Heinz entered the baby food industry in 1931. They have 55 baby food items including baby cereals, custards, snacks, Puree, and more.

Another baby food brand, “Biomol” is popular formula milk for infants. It is a product of FASSKA, a Belgium-based company, but they reportedly operate through Vitalac Dairy and Food Industries Ltd in Bangladesh.

There is also Eldobaby, a Swiss infant formula, which has a wide range of product variations for infants to 2+ years of kids. They have another popular brand called Eldomilk.

PediaSure is another brand of nutrition supplement drinks for children aged 1 year to teenagers, manufactured by Abbott Nutrition.

Department of Livestock Services Director (Production) Dr ABM Khaleduzzaman told The Business Post that they indeed think that there is a need for taking steps to increase dairy products including the production of baby foods by increasing the use of locally produced milk.

No initiative by local brands

Currently, at least 15 companies, registered under Bangladesh Standards and Testing Institution (BSTI), produce and supply pasteurised, milk and dairy products to the market.

They include Milk Vita, Pran Dairy, Aftab Milk and Milk Products, Akij Food and Beverage, American Dairy Limited, Baro Awlia Dairy Milk and Foods, BRAC Dairy and Food Project, Danish Dairy Farm, Ichhamoti Dairy and Food Products, Igloo Dairy Limited, Uttar Bango Dairy, Purbo Bangla Dairy Food Industries, and Tania Dairy and Food Products.

The companies produce various types of dairy products but they have no initiative to make baby foods locally.

When asked, PRAN-RFL Group Director (Marketing) Kamruzzaman Kamal told The Business Post, “The country’s dairy industry is still growing and now our attention is on producing basic dairy products.

“We have no plan right now to produce baby food but our dairy company will gradually go for it.”

Editor & Publisher: S. M. Mesbah Uddin

Published by the Editor from House-45,

Road-3, Section-12, Pallabi, Mirpur

Dhaka-1216, Bangladesh

Call: +01713180024 & 0167 538 3357

News & Commercial Office :

Phone: 096 9612 7234 & 096 1175 5298

e-mail: financialpostbd@gmail.com

HAC & Marketing (Advertisement)

Call: 01616 521 297

e-mail: tdfpad@gmail.com