Private sector credit gallops to 14% amid rising inflation

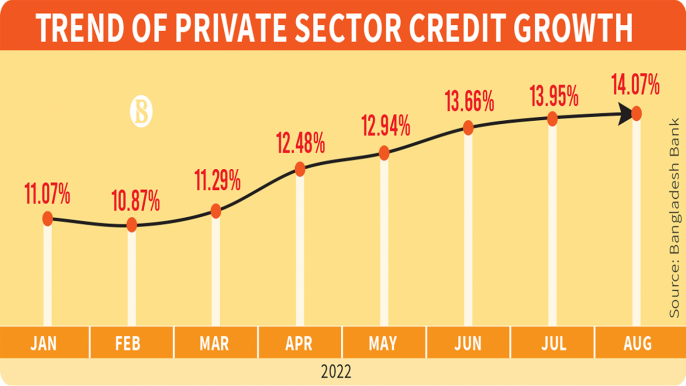

At a time when global central banks are tightening monetary policy to tame inflation, Bangladesh is going in the opposite direction with credit growth crossing 14% in August, a four-year high.

Though inflation cooled slightly in July, rising credit growth has turned the heat on prices of goods and services.

In August, credit growth reached 14.07% signalling that it may cross the monetary target of 14.1% set for the current fiscal year by the Bangladesh Bank in its latest monetary policy.

High import costs amid the rising dollar price led to increased financing costs, which contributed to the increase in private sector credit growth, said industry insiders.

Zafar Alam, managing director of Social Islami Bank, said although the central bank in this year's monetary policy has slightly reduced the credit growth of the private sector, it has kept the interest rates on bank loans the same.

Hence, credit growth is increasing as customers are getting loans at low interest rates.

Interest rates are currently around 9%, which economists say should be higher given the current economic situation.

Zafar also said the prices of all kinds of products have increased leading to manufacturers incurring additional costs, which in turn has spurred credit growth in the private sector.

Overall, inflation dropped by 0.08 percentage points in July after five months of sharp increases. Food inflation stood at 8.19%, registering a drop of 0.18 percentage points from June.

The government is expecting inflation to ease further in the coming months as oil prices in the global market have fallen.

Planning Minister MA Mannan recently pointed out that the overall fall in inflation largely depended on a reduction in food inflation.

The rate of inflation would fall further in the coming months as commodity prices were decreasing in the global market, he said.

Hoping that the price of the dollar will come down, Finance Minister AHM Mustafa Kamal also said inflation may return to normal within the next one to two months.

Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank Limited (MTB), told The Business Standard that bank loans have increased as the country's imports increased post-Covid.

In addition, prices per dollar rose by about 22% in a year which increased debt due to higher cost of consumption.

"The interest rate of loans in banks is very low. Customers are getting loans easily due to which the amount of credit is increasing. We have to see where the customers are spending these loans and it should be considered before disbursement."

According to Bangladesh Bank data, last September the price per dollar in the country was Tk85. Since then, the country started selling dollars from its reserves as imports increased, with the regular dollar sales taking its price to Tk86 amid depleting reserves.

The dollar crisis continued to increase from April this year resulting in fresh hikes in dollar price. The central bank is considering Tk96 per dollar for government imports, while the interbank rate is being traded at a maximum of Tk105.35.

As part of tightening the money flow, the private sector credit growth ceiling was cut to 14.1% for FY23 from 14.8% of FY22, according to the monetary policy statement of the current fiscal year.

Earlier in 2020, the pandemic, along with deepening uncertainties, pushed down the private sector credit growth to around 8%.

Former Bangladesh Bank governor Salehuddin Ahmed said inflation is increasing due to the increase in the price of goods in the international market. To reduce this inflation, money supply has to be reduced.

If the supply of money in people's hands increases, then inflation will increase.

"The growth of private sector credit has increased, but if it is spent on the production sector, it will not affect the inflation. If production increases, prices will become affordable and inflation will continue to decrease," he said.

According to a report of the Bangladesh Bank, the excess liquidity in the country's banking sector was Tk2.03 lakh crore in the month of June. In the space of one month in July, the amount of excess liquidity stood at about 1.9 lakh crore.

In August in the last fiscal year, the central bank's reserves stood at $48 billion. However, in the outgoing financial year, it sold $7.6 billion to banks due to increased import volumes and higher import costs. In addition, as a result of sales of more than $3 billion so far this year, the amount of reserves stood at $36.97 billion on September 21.

The highest trade deficit in the country's history was registered in the fiscal year 2021-22, stemming from an increase in the cost and volume of imports compared to exports in the outgoing fiscal year.

The trade deficit was $33.25 billion. At the same time, the deficit in the current account balance of foreign transactions also exceeded $18.5 billion.

However, the dollar market of some countries is in a somewhat normal position due to the decrease in import costs and increase in remittances from the beginning of the current financial year.

Furthermore, import volume has been in a downward trend for the past two months. Import in terms of LC (Letter of Credit) settlement dropped 20% in August from the previous month owing to various steps such as elevating the LC margin to 100% to stabilise the country's foreign exchange market. The opening of LCs was also on a downward trend.

LC payments stood at $5.93 billion in August, a drop from $7.42 billion in the previous month, according to the latest report of the Bangladesh Bank.

Editor & Publisher: S. M. Mesbah Uddin

Published by the Editor from House-45,

Road-3, Section-12, Pallabi, Mirpur

Dhaka-1216, Bangladesh

Call: +01713180024 & 0167 538 3357

News & Commercial Office :

Phone: 096 9612 7234 & 096 1175 5298

e-mail: financialpostbd@gmail.com

HAC & Marketing (Advertisement)

Call: 01616 521 297

e-mail: tdfpad@gmail.com