VAT collection grows 20% in August

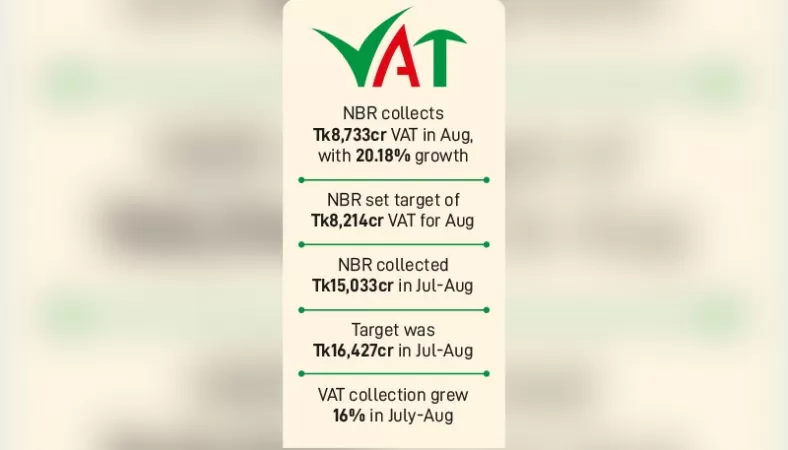

Value-added tax (VAT) collection grew more than 20 per cent year-on-year to Tk 8,733 crore in August thanks to the soaring inflation and innovative strategies taken by the National Board of Revenue.

The VAT collection exceeded 6.32 per cent in August from the monthly target set, according to the NBR.

However, the VAT collection rose 15.96 per cent in July-August period compared to the same period of the previous year, according to the board.

“The strict monitoring, alternative and innovative strategies, and rising inflation ate the major causes for the increase in VAT collection,” said an official at the tax administration.

Despite reducing government expenditures in development projects due to the austerity measures regarding releasing funds, the NBR witnessed robust growth in VAT collection in August, he said.

However, Advance Tax (AT) from the organised sector decreased by 21 crore to Tk 1,170 crore during July-August period in the current fiscal year. The figure was Tk 1,191 crore in the same period a year earlier. However, the VAT from the organised sector registered a 10.20 growth during the period.

According to the NBR data, Cumilla Commissionerate witnessed the highest revenue growth with over 58 per cent until August in the current fiscal year, followed by Chittagong Commissionerate with around 50 per cent and Khulna Commissionerate with over 34 per cent.

In contrast, Rangpur Commissionerate witnessed a fall in revenue collection.

During the July-August period, the NBR collected Tk 380.86 crore in VAT from the Large Taxpayer Unit, a rise of 5.87 per cent compared to the same period of the previous fiscal year.

Commenting on the VAT collection growth, Centre for Policy Dialogue Research Director Khondaker Golam Moazzem said, “The revenue grew due to the rising prices of every essential. It is inflation-induced revenue growth.”

“At the same time, the soaring prices also helped the rise in VAT collection. But as the spiraling inflation squeezes the consumption, the VAT collection might see a fall in days to come.”

The NBR needs to pay attention to the small and medium enterprises to widen the tax nets instead of focusing only on large taxpayers and to set up more EFD [Electronic Fiscal Device) to ensure accountability in VAT collection.

The revenue collection target for fiscal 2022-23 was set at Tk 3,70,000 crore, including Tk 1,28,873 crore in VAT.

Editor & Publisher: S. M. Mesbah Uddin

Published by the Editor from House-45,

Road-3, Section-12, Pallabi, Mirpur

Dhaka-1216, Bangladesh

Call: +01713180024 & 0167 538 3357

News & Commercial Office :

Phone: 096 9612 7234 & 096 1175 5298

e-mail: financialpostbd@gmail.com

HAC & Marketing (Advertisement)

Call: 01616 521 297

e-mail: tdfpad@gmail.com