Remittances thru’ state banks drop 35%

Private banks in positive growth

Remittance influx to state-run commercial banks dropped around 35% in the April-June quarter, compared to that of the same period of the previous year, while private commercial banks witnessed a positive growth of 1.57%.

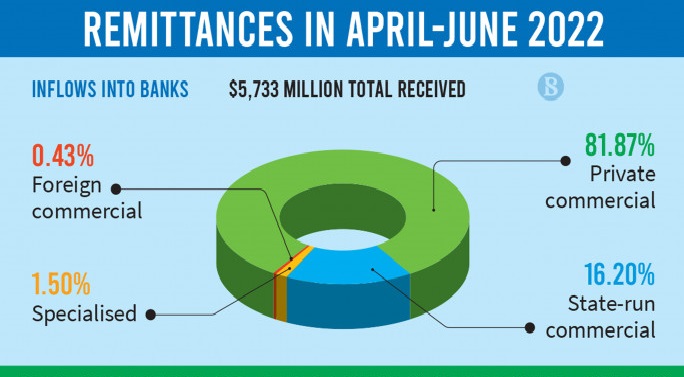

The overall remittance flow was $5733.42 million during the quarter, 7.22% lower year-on-year, according to the central bank's latest report. It was $6179.48 million in the April-June quarter of 2021.

Bankers said the June quarter trend also continued in July and August.

"Banks directly receive only 10% of remittance, while the rest come via exchange houses, mostly foreign ones. In the crisis time of dollar, the foreign money changers bargained for possible highest rates," a private bank treasury head, wishing to remain unnamed, told FP.

"The banks [mostly private ones] who offered higher prices received higher remittance dollars from the competitive greenback market," he added.

A state-owned bank treasury department senior official, seeking anonymity, told TBS, "We could buy dollars from the central bank's reserve, even if it is less than the demand. Since the remittance dollar price remained high, we did not buy it, unless we were forced."

"We also abstained from buying the dollars at such high rates from the fear that it might make a loss for us," he said, adding that other state-banks also thought so, which led to a fall in their remittance earnings.

Association of Bankers Bangladesh (ABB) Chairman Salim RF Hossain told TBS that the services of private banks are better than that of state-run banks which is one of the reasons behind their growth in receiving remittances.

"Besides, many private banks including Islami Bank and Bank Asia have extensive networks of branches across the country. Remittance recipients can easily withdraw money from the branches," he, also managing director of Brac Bank, added.

The state-run Agrani Bank, Janata Bank, Rupali Bank, Sonali Bank, and BASIC Bank received $928 million in remittance in the April-June quarter of 2022, nearly $500 million or 34.84% down from $1,425 million of the corresponding time of previous year.

Hence, the contribution of the five banks to the country's remittance influx decreased to 16.2% from 23.06%, the Bangladesh Bank data said.

Among the state-run banks, Agrani Bank performed the best in bringing around $625 million in remittance during the April-June quarter of 2021 but its remittance earnings declined by 41.38% to $366 million this time. Another great performer, Sonali Bank, also witnessed a 26% fall.

The central bank also said remittances to private banks have been on the rise for the past few years. They brought $4,694 million or 81.87% of the total remittance during this June quarter, registering a 1.57% year-on-year growth.

Although many of them witnessed a jump in remittance earnings, some posted negative growth. For example, remittance to Islami Bank Bangladesh dropped 39.24% to $1,097 million during the quarter.

Talking to TBS, officials of the treasury department of several banks said a large portion of the country's remittance income used to come through state-run Agrani Bank even a few years ago. Since the central bank introduced the Bangladesh Electronic Funds Transfer Network (BEFTN), the contributions of private banks to bringing expatriate Bangladeshis income to home have been on the rise.

Insiders said the interbank foreign exchange was almost closed for several months amid the dollar crisis and the supply of dollars from the central bank was much less than the demand. As a result, private banks were forced to rely on remittance dollars from the foreign exchange houses.

Capitalising on the dollar crisis and soaring rates, many private banks made unusual profits and some of them also faced the music for that.

Meanwhile, on 11 September, banks decided to buy remittance dollars at Tk108. Interbank dollar transactions also resumed.

Editor & Publisher: S. M. Mesbah Uddin

Published by the Editor from House-45,

Road-3, Section-12, Pallabi, Mirpur

Dhaka-1216, Bangladesh

Call: +01713180024 & 0167 538 3357

News & Commercial Office :

Phone: 096 9612 7234 & 096 1175 5298

e-mail: financialpostbd@gmail.com

HAC & Marketing (Advertisement)

Call: 01616 521 297

e-mail: tdfpad@gmail.com