Excess liquidity falls amid lingering forex crisis

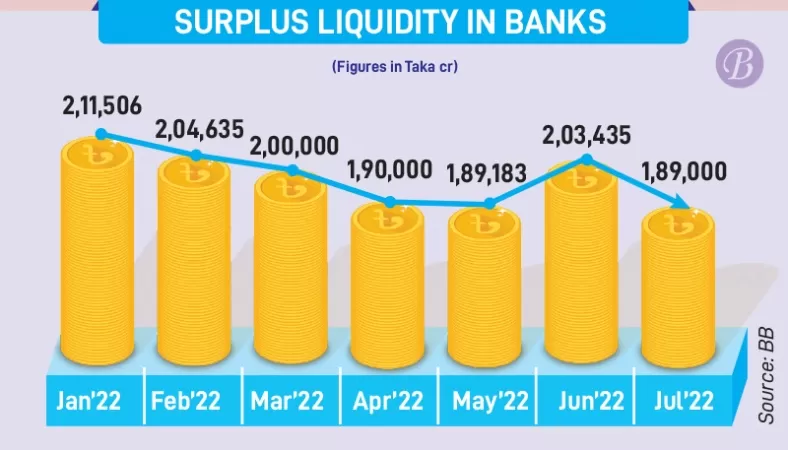

Excess liquidity in the country’s banking sector fell to Tk 1,89,000 crore in July – from Tk 2,03,435 crore in June – due to the ongoing foreign exchange crisis that has been putting a serious pressure on reserves.

Latest data from the Bangladesh Bank show that of the total surplus liquidity in July, the state-run banks hold Tk 71,000 crore, private commercial banks hold Tk 92,000 crore and foreign banks hold Tk 26,000 crore.

A major portion of the surplus funds have been invested in government bonds.

Central bank data show that the surplus liquidity was at Tk 2,11,506 crore in January this year. The excess liquidity has been falling due to the ongoing volatility in the foreign exchange market.

Some new generation banks and weak banks are currently facing liquidity shortages despite high excess liquidity in the sector, said senior officials of the Bangladesh Bank. Private bank officials said banks are currently facing a big liquidity crunch as the forex crisis lingers on. Speaking to The Business Post, Dhaka Bank Managing Director and CEO Emranul Huq said, “Banking sector’s surplus fund has declined mainly due to growing import financing. The lenders are now spending more local currency to buy USD for settling letters of credit (LCs).

The settlement of LCs, also known as actual import payment, rose by 63.06 per cent to $7.64 billion in July, the first month of the current fiscal year, according to the banking regulator data. Of the figure, the settlement for petroleum imports rose by 116.18 percent to $1.28 billion.

The Dhaka Bank chief said the import payments got higher due to fuel price hikes in the global market, triggered by the Russia-Ukraine war.

Current forex market situation

On Monday, the inter-bank exchange rate stood at Tk 95 per USD, while the importers are spending more than Tk 100 per USD to pay import bills.

To meet the US dollar shortage in the banking sector, the central bank is continuously selling USD to banks. As a result, the foreign exchange reserve continues to fall. On Monday, the forex reserves stood at $38.91 billion, down from $48 billion in August of last year.

The forex reserves may fall to $37 billion today as the Bangladesh Bank is scheduled to make a routine payment worth $1.73 billion to the Asian Clearing Union (ACU) against imports made during the July-August period of 2022.

Editor & Publisher: S. M. Mesbah Uddin

Published by the Editor from House-45,

Road-3, Section-12, Pallabi, Mirpur

Dhaka-1216, Bangladesh

Call: +01713180024 & 0167 538 3357

News & Commercial Office :

Phone: 096 9612 7234 & 096 1175 5298

e-mail: financialpostbd@gmail.com

HAC & Marketing (Advertisement)

Call: 01616 521 297

e-mail: tdfpad@gmail.com