Cement prices hit all-time high

The prices of cement, one of the key construction materials, have reached an all-time high in Bangladesh’s history.

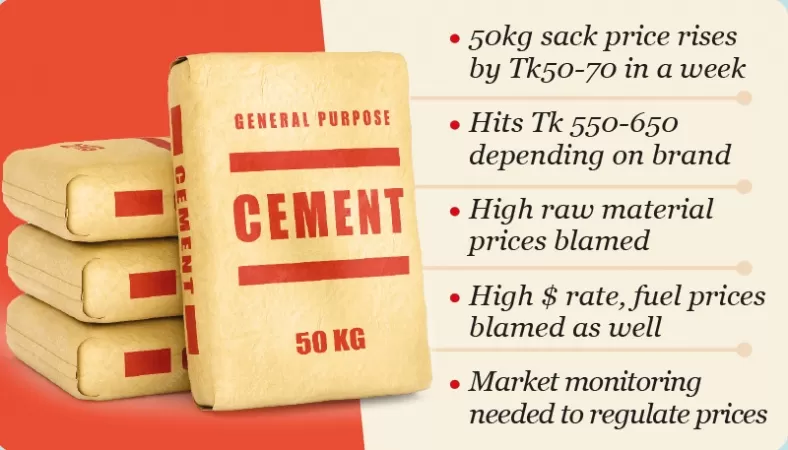

A 50-kg sack of cement was sold between Tk 550 and Tk 650 depending on brand and quality at the shops in Dhaka on Sunday, marking a Tk 50-70 rise in a week.

Manufacturers have blamed the high dollar rate against the taka and the recent fuel price hikes for a 20-25 per cent hike in production costs that have led to the rise in cement price.

They also claimed that the prices of raw materials, which they import, that are needed to produce cement have significantly increased in the global market recently and that has played a major role in pushing up the cement price in the local market.

Industry insiders say the country imports around 20 million tonnes of five raw materials — clinker, limestone, slag, fly ash and gypsum — worth around Tk 7,000-8,000 crore every year.

There are 76 cement manufacturing companies in Bangladesh but only 42 of them — big, medium, and small businesses — are now operational. Seven of the 42 companies are listed on the stock exchanges, according to the Bangladesh Cement Manufacturers Association (BCMA).

Of all the companies, cement of Holcim, Scan, Crown, SuperCrete, Fresh, Shah, Premier, Metrocem, Akij and Seven Rings are currently the most popular ones in the market, on spot visits found.

Talking to The Business Post, Mithun Bepari, proprietor of Mithun Enterprise in Old Dhaka’s Bangshal, said they were selling each sack of Holcim Shokti cement at Tk 650 and normal item of the brand at Tk 600, while Shah and Premier cement cost Tk 550 per sack.

“We sell the product as per the companies’ fixed rates and make a small profit. If companies reduce the rates, we will be able to sell at reasonable prices. We are also suffering from the hiked rates of all products,” he added.

However, a 50-kg sack of Holcim cement is being sold at highest Tk 620-630 in the district level, according to traders.

What happened?

Bangladesh Cement Traders Association (BCTA) Vice President Rezaul Chowdhury said, “We suffer more if the prices go up suddenly. The price of a 50-kg sack went up by Tk 70 in the past two weeks. Manufacturers have also warned us that the rate may go up by Tk 30 more in the next week.”

He said their sales dropped significantly after the recent price hike because many people were forced to stop construction work. “We are facing a challenging time since there is no authorised body to monitor the market properly and control product prices.”

“The government should investigate and find out whether a syndicate is behind the sudden price hike and taking advantage of the situation,” urged Rezaul, also the proprietor of Dhaka Trade and Builders Limited.

Metrocem Managing Director (MD) Md Shahidullah said they import key raw materials, including clinker, from Indonesia, Malaysia, United Arab Emirates, Saudi Arabia, Vietnam, Pakistan and Thailand.

“Prices of these materials have almost doubled compared to last year. Freight fare has also gone up recently. Clinker prices will not reduce until the Russia-Ukraine war ends and the USD rate decreases,” he added.

Premier Cement Mills Limited MD and CEO Mohammed Amirul Haque told The Business Post, “The price of one-litre diesel has been increased from Tk 65 to Tk 114 and the dollar rate is now over Tk 114. We also have to pay a huge amount of VAT.

“All these unavoidable issues have pushed up production costs by 20-25 per cent and that has created an impact in the market.”

Cement industry data

The 42 operating cement companies currently have an annual effective capacity of around 58 million tonnes, compared to a demand of around 31 million tonnes. And 10 of them, including two multinational ones, dominate the industry by holding nearly 75 per cent of the total market share, according to EBL Securities Ltd Report 2022.

The report said per capita cement consumption in Bangladesh is about 210 kgs at present. On the other hand, the per capita consumption is 1,700 kgs in China, 690 kgs in Malaysia, 620 Kgs in Thailand, 517 kgs in Vietnam, 412 kgs in Sri Lanka, and 305 kgs in India.

Bangladesh also exports cement to India, Sri Lanka, Myanmar, Nepal and the Maldives. The northeastern states of India, mainly Assam and Tripura, are the biggest customers.

The country exported cement, salt, stone, etc. worth $9.57 million in FY2021-22, says latest Export Promotion Bureau data.

According to a recent report of IDLC, there are 60,000 people directly employed and 10 lakh indirectly employed in the country’s cement industry, where Tk 42,000 crore has been invested so far.

Over the last seven years, the industry’s compound annual growth rate was approximately 11.5 per cent.

Editor & Publisher: S. M. Mesbah Uddin

Published by the Editor from House-45,

Road-3, Section-12, Pallabi, Mirpur

Dhaka-1216, Bangladesh

Call: +01713180024 & 0167 538 3357

News & Commercial Office :

Phone: 096 9612 7234 & 096 1175 5298

e-mail: financialpostbd@gmail.com

HAC & Marketing (Advertisement)

Call: 01616 521 297

e-mail: tdfpad@gmail.com