New tax measures could impact listed cos’ sales

The proposed budget for FY23 will negatively impact the earnings of publicly traded consumer electronics, appliances, toiletries and automobile companies, as the new tax measures on sourcing raw material will cause their production costs to go up, analysts say.

This direct impact might be difficult to pass on to consumers and stock investors of listed companies, mainly Walton, Singer Bangladesh, Runner Automobiles, Reckitt Benckiser, Marico, ACI, and Kohinoor Chemical Company.

Nagad

Analysts at the country’s top stock brokerages further added that some policy measures taken by the government in the proposed budget for FY23 are likely to have an adverse effect on those companies’ sales.

Placing the budget for FY23 in Parliament on Thursday, Finance Minister AHM Mustafa Kamal had proposed the withdrawal of full exemption and imposed a 5 per cent VAT at the local manufacturing stage on refrigerators and freezers.

CAL Securities, the first foreign stock brokerage in Bangladesh, in its budget review says that the refrigerators contribute to 92 per cent of WALTON’s sales and 40 per cent of SINGER Bangladesh. The imposition of the above mentioned VAT might be difficult to pass on to consumers.

Commenting on the move, Managing Director of Walton Hi-Tech Industries Ltd Golam Murshed told The Business Post, “A 5 per cent extra Value Added Tax will mean 5 per cent less revenue from gross sales.”

Echoing the same, another top stock brokerage LankaBangla Securities Ltd stated that the withdrawal of the full exemption could cause refrigerator and freezer prices to rise, affecting industry growth particularly, as the liquidity may decrease.

EBL Securities Ltd in its budget review also pointed out that the overall local manufacturing cost of refrigerators and freezers will go up. However, local manufacturing costs of compressors will decline, and domestic lift manufacturers will be more competitive, it added.

5% VAT could impact three-wheeler sales

According to the proposed budget for FY23, a 5 per cent VAT will be applicable at the manufacturing stage of three-wheelers as well, and VAT (including advance tax) and supplementary duty will be exempted on imports of raw materials and parts till June 30, 2025.

According to the analysis conducted by CAL Securities, three-wheelers contribute about 20 per cent of Runner’s revenue. Considering the three-wheeler consumer demography, the 5 per cent VAT is likely to have an adverse effect on sales.

The budget for FY23 proposes VAT exemption at local manufacturing stage, and VAT and supplementary duty exemption on import and local purchase of raw materials and parts to manufacture motor vehicles up to 2,500 CC and power tillers till June 30, 2030.

This move will have a positive impact on Runner Automobiles and ACI Motors, which are subsidiaries of the ACI Ltd.

For FY23, the supplementary duty on shaving, beautification, air fresheners, toiletries, disinfectants, and depilatory items could increase by 10 to 20 per cent.

These measures will have a negative impact on the earnings of listed companies Reckitt Benckiser, Marico, ACI, and Kohinoor Chemical Company.

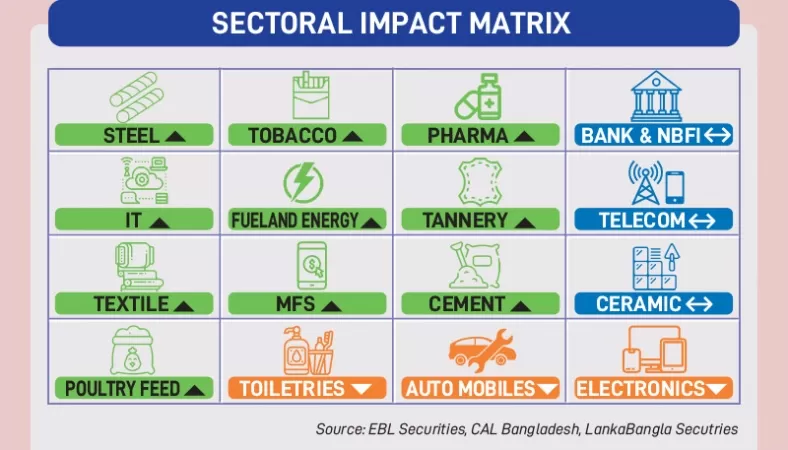

According to the analysts, the proposed budget will have a positive impact on construction, tobacco, pharma, tanner, poultry feed, cement, textile, fuel, and energy industries.

Besides, the corporate tax rate has been reduced by 2.5 per cent for non-publicly traded manufacturing companies. But listed companies, with a 10 per cent IPO size of total paid-up capital, will pay 2.5 percent less tax.

The corporate tax rates of banks, insurance, NBFIs, merchant banks, tobacco manufacturing companies, and telecom companies have been kept unchanged.

According to EBL Securities, this move will increase the profitability of listed companies having more than 10% IPO or tradable share.

A company’s dividend income, on the other hand, remains unchanged at 20 per cent, but individual investors will be taxed at their respective tax rates. Such taxes were exempted for up to TK 50,000.

Editor & Publisher: S. M. Mesbah Uddin

Published by the Editor from House-45,

Road-3, Section-12, Pallabi, Mirpur

Dhaka-1216, Bangladesh

Call: +01713180024 & 0167 538 3357

News & Commercial Office :

Phone: 096 9612 7234 & 096 1175 5298

e-mail: financialpostbd@gmail.com

HAC & Marketing (Advertisement)

Call: 01616 521 297

e-mail: tdfpad@gmail.com