Financial houses shy about PPP

The government wants their money for its projects but they are shying away as they consider the projects unattractive.

Domestic funding for public-private partnership development projects have thus become hard to come by as banks and financial institutions are reluctant to finance such projects considered risky by them.

So the Public Private Partnership (PPP) Authority has hit a major stumbling block in realising its PPP projects as only a single domestic financial institution has stepped in to finance a project out of the 14 the PPP Authority had roped in five years back.

The deals were penned with the banks and non-bank financial institutions to ensure domestic funding for PPP projects. Only the Bangladesh Infrastructure Finance Fund Limited (BIFFL) has so far come forward.

It has been five years since the Public Private Partnership (PPP) Authority struck deals with 14 banks and non-bank financial institutions to ensure domestic funding for PPP projects, but only the Bangladesh Infrastructure Finance Fund Limited (BIFFL) has so far come forward to finance a single project.

Other financial institutions have stayed away from such projects for various reasons, including collateral-related problems, putting a damper on the PPP projects, according to a letter sent by the PPP Authority to the finance ministry in June this year.

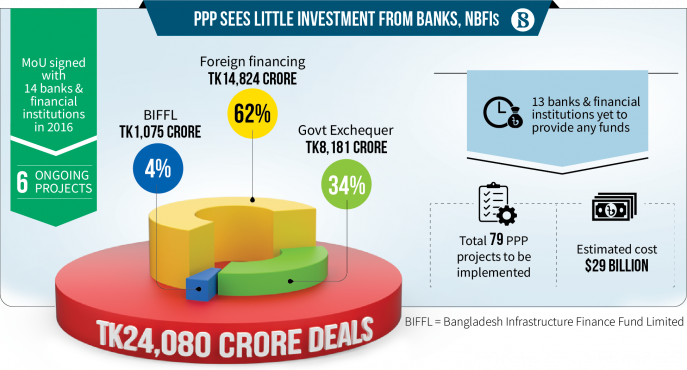

The government has till date finalised 79 projects, involving $29 billion, to be implemented under the PPP mechanism since the PPP concept in infrastructure development with the private sector's involvement was pitched from the fiscal 2009-10.

Investment deals to the tune of Tk24,080 crore have so far been signed for six ongoing PPP projects. Of the amount, Tk8,181 crore are coming from the government coffer, while the lone domestic financial institution, BIFFL, provided only Tk1,075 crore in the Dhaka bypass expressway project. The remaining funds will come from foreign sources.

The remaining 13 banks and non-bank financial institutions have not provided a single penny to any projects, said Sultana Afroz, chief executive officer of the PPP Authority, in the letter.

The memoranda of understanding signed with them in 2016 failed to remove barriers to the funding for PPP projects, she added.

Banks are not interested in lending without collateral. But there is no scope to put up government land as collateral for bank loans for PPP projects. The banks often require personal guarantees from project directors for such loans, which is not realistic as well.

Sultana also mentioned other barriers to funding for such projects, like the reluctance of banks to provide long-term loans with short-term deposits and the single borrower exposure limit.

Bankers say collateral-related issues apart, the major problems in financing PPP projects are long delays in project implementation and repeated extension of project tenures.

Besides, financial institutions are reluctant to finance such projects because of a lack of good relations with the local private companies that are implementing these projects, they add.

Seeking anonymity, the chief executive officer of a bank said, "We finance various projects in the private sector for a period of five-seven years. In that case, banks have control over the borrower organisations. But many government and private firms are involved with the implementation of PPP projects, which take 15-20 years for completion and banks have no control over them."

Long-term lending to unregulated institutions is very risky for banks and non-bank financial institutions.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank that has a contract with the PPP Authority, told The Business Standard that it is not possible for commercial banks to finance the government's infrastructure development projects. It is necessary to ensure institutional funding for PPP projects by overcoming implementation delays.

There will be a need for government guarantees to ensure financing from banks, he added.

While placing the budget for FY10, the then Finance Minister Abul Maal Abdul Muhith expected to get Tk1.96 lakh crore through the PPP mechanism in the next five years. But his high ambitions were dashed for failure to attract the private sector. A decade later, the current finance minister AHM Mustafa Kamal has also admitted it.

"It is true that we have not been able to take the PPP concept well yet. Nevertheless, we have started our work and it needs time to start anything jointly," he told reporters after a cabinet meeting on public procurement last week.

Sultana, in the letter, requested the finance ministry to give specific instructions to banks and non-bank financial institutions to finance PPP projects.

Editor & Publisher: S. M. Mesbah Uddin

Published by the Editor from House-45,

Road-3, Section-12, Pallabi, Mirpur

Dhaka-1216, Bangladesh

Call: +01713180024 & 0167 538 3357

News & Commercial Office :

Phone: 096 9612 7234 & 096 1175 5298

e-mail: financialpostbd@gmail.com

HAC & Marketing (Advertisement)

Call: 01616 521 297

e-mail: tdfpad@gmail.com