Tax cuts eat into tax-GDP ratio: NBR

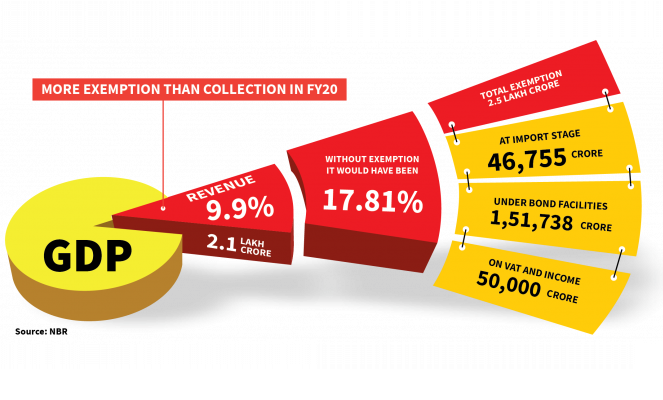

The National Board of Revenue (NBR) estimates that the tax-GDP ratio was 9.9% in the fiscal year 2019-20, but it would have been 17.81% had the government not provided tax exemptions.

It says the government provided tax exemptions of around Tk2.5 lakh crore to facilitate growth in different sectors in FY20. It realised Tk2.18 lakh crore in revenue that year against a target of Tk3 lakh crore.

Of the total exemptions, Tk46,755 crore was exempted for importing raw materials, capital machinery, and other goods while Tk1,51,738 crore was waived against bond facilities for export-oriented industries.

Besides, VAT and income tax exemptions amounted to about Tk50,000 crore, found a recent NBR survey conducted to find out how much tax is exempted each year.

The survey findings were presented to Prime Minister Sheikh Hasina before the FY22 budget was placed in Parliament on 3 June.

According to the General Economic Division, the 7th five-year-plan had projected the tax-GDP ratio would be 13.7% for FY20, however, the actual ratio was 7.9%.

The 8th five-year plan also projected that the tax-GDP ratio would be 12.25% for FY25.

The government has been facilitating growth through tax exemptions, reduced tax rates, and tax holidays to accelerate local business and attract foreign direct investment, the revenue board said.

Manufacturing, agriculture and forestry, fishing, mining and quarrying, electricity, construction, transport, storage and communication, financial intermediation, real estate and renting, defence, public administration, and education sectors mainly get tax exemption facilities, according to the NBR.

The manufacturing sector's contribution to GDP is the highest and it usually gets the highest tax exemption every year. Small manufacturers got up to 90% tax exemption in FY20 while it was 44% for large and medium companies.

Bangladesh Foreign Trade Institute's former chief operating officer Ali Ahmed told The Business Standard the government offers tax holidays and tax cuts to expand the tax base, and create investment and employment opportunities.

He said the FY22 budget proposed providing a 20-year tax holiday for the automobile industry to encourage local and foreign investors to go into car and jeep manufacturing.

With this, the government has opened a new area of revenue collection as those companies will pay import duties and also collect sales VAT, said Ali, also a former NBR board member.

Such tax facilities will create opportunities to grow a new industry while there will be more jobs, which will contribute to more revenue collection, he added.

NBR former chairman Mohammad Abdul Majid said Bangladesh lags in tax-GDP ratio for three reasons.

"One, we cannot realise revenue from every citizen and sector supposed to pay taxes. Indirect tax is collected from citizens but it does not go to state coffers. This reduces the tax-GDP ratio by 2-3%."

Second is tax exemption, which also reduces the ratio by about 3%, he said. "For example, everyone shows earnings from agriculture and fisheries to get tax exemption."

He said large sectors, such as clothing, make profits every year but do not pay taxes.

The third reason is that the government itself does not pay taxes, which makes it a defaulter, he said.

"This brings down the tax-GDP ratio by another 2%. The government does business through state-owned enterprises, such as the power development board and Dhaka Water Supply and Sewerage Authority. It also collects taxes from citizens. But it does not deposit the money in the state exchequer."

Majid further said the government either manages tax exemptions for big projects, such as the Padma bridge, in advance or does not pay those taxes at all.

He said these three reasons cause the tax-GDP ratio to go down by 7-8%.

If this system loss can be solved and the tax net can be expanded, the tax-GDP ratio would be higher, he added.

Commenting on increasing tax revenue, Dhaka Chamber of Commerce & Industries (DCCI) President Rizwan Rahman said that the government may set an annual target for tax officials and provide incentives to them to expand the tax net, similar to the revenue target.

Tax officials should be made more accountable to eliminate taxpayers' fears about tax-related harassment. The government may provide tax holidays for young entrepreneurs, new investors and startups, which will help to expand the tax net as well as increase the tax GDP ratio, he added.

Rizwan Rahman also thinks if payroll tax is made mandatory for all it will help realise more taxes.

The DCCI president said about 8,500 parts are needed to build a car. The new budget has proposed tax holidays for the automobile industry, which will create more suppliers in the industry.

Editor & Publisher: S. M. Mesbah Uddin

Published by the Editor from House-45,

Road-3, Section-12, Pallabi, Mirpur

Dhaka-1216, Bangladesh

Call: +01713180024 & 0167 538 3357

News & Commercial Office :

Phone: 096 9612 7234 & 096 1175 5298

e-mail: financialpostbd@gmail.com

HAC & Marketing (Advertisement)

Call: 01616 521 297

e-mail: tdfpad@gmail.com