Excess liquidity: BB wants rise in savings tools rates

The Bangladesh Bank is now pursuing the government to raise interest rates of savings certificates to discourage depositors from parking their money in the banking system as banks are now burdened with excess liquidity.

Excess liquidity – pushed up through policy relaxation and pumping of fresh money into the banking system in the pandemic year by the Bangladesh Bank – has now turned into a problem for banks with both lending and deposit rates having come down to a low level that is starting to hurt core banking business and depositors.

The central bank has already informed the government of the current excess liquidity problem along with recommendations for raising interest rates of savings certificates and simplifying investment conditions for small depositors.

Currently, the highest interest rate of savings certificates is 11.5% when interest rates on deposits came down to 3% to 4% because of liquidity surplus.

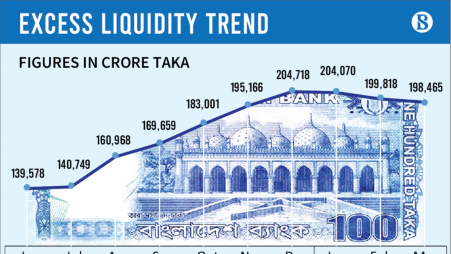

The total excess liquidity in the banking sector stood at Tk1,98,465 crore at the end of March this year.

The excess liquidity had crossed Tk2 lakh crore in December last year, the highest in recent history.

The high inflow of remittance during the pandemic was one of the major reasons for an escalation of excess liquidity. Remitters are fueling bank deposits amid limited spending and investment options during this crisis period.

The foreign exchange reserve stood at over $44 billion in May, thanks to a good inflow of remittances. The high reserve supplies more liquidity to the market as the Bangladesh Bank purchases dollars from banks injecting more money into the market.

Even with a negative return amid a low deposit rate, the banking sector saw a 13% year-on-year growth in January this year, according to Bangladesh Bank data.

Cheap money brought down lending rates to 5%-7% when implementing the 9% rate was difficult for banks a year back.

However, borrowers are showing reluctance to take out loans despite getting the lowest lending rate in recent history because of uncertainty in the pandemic situation.

The credit growth has remained sluggish at an 8% level since then, far below the monetary target of 14.8% for June this year set by the Bangladesh Bank.

On the other hand, government borrowing also declined due to slow project implementation, causing a drastic fall in yields of government treasury bills and bonds to 1% to 4%, which was above 9% last year.

Liquidity shortage or excess liquidity both are bad for the financial market, said Ali Reza Iftekhar, managing director of Eastern Bank and chairman of Association of Bankers, Bangladesh (ABB).

He said the time has come to mop up excess liquidity to keep the money market stable.

"We informed the government of the disruption in the money market caused by excess liquidity," said a top manager of the Bangladesh Bank preferring to remain anonymous.

Raising interest rates of savings instruments will create a win-win situation for all relevant parties, including banks, depositors and the government, he added.

If the interest rates are raised and investment conditions simplified for small depositors, low-income and middle-income people will benefit. On the other hand, when money is diverted to savings instruments, it will help banks to reduce their cost of maintaining excess liquidity, he also said.

Moreover, the government will not be a loser in the sense that its demand is now low and raising the interest rates of savings instruments will help widen safety net programmes during this crisis period, the central bank official said.

When the government is facing a huge shortfall in revenue collection during the pandemic, raising interest rates of savings instruments will further increase its expenditure.

The government has projected interest payments amounting to Tk69,200 crore on savings instruments for the current fiscal year, which is significantly more than the actual budgetary target of Tk37,365 crore for the fiscal 2019-20.

However, the target of interest payments for FY20 doubled to Tk67,546 crore following a huge buying spree of savers because of a low interest rate against bank deposits.

Since 1 July 2019, the government has imposed a 10% source tax on profits from investments of more than Tk5 lakh. The government has made a provision of tax identification numbers mandatory for investments and bared cash transactions.

Despite strict conditions, sales of saving certificates have already crossed the target set by the government for the current fiscal year.

The net sales of saving certificates in July-March of the current fiscal year stood at Tk33,000 crore, which was 65% higher from the target of Tk20,000 crore.

In this situation, the excess liquidity problem has prompted the government to raise interest rates of savings instruments to divert money from banks.

Raising inter

Editor & Publisher: S. M. Mesbah Uddin

Published by the Editor from House-45,

Road-3, Section-12, Pallabi, Mirpur

Dhaka-1216, Bangladesh

Call: +01713180024 & 0167 538 3357

News & Commercial Office :

Phone: 096 9612 7234 & 096 1175 5298

e-mail: financialpostbd@gmail.com

HAC & Marketing (Advertisement)

Call: 01616 521 297

e-mail: tdfpad@gmail.com