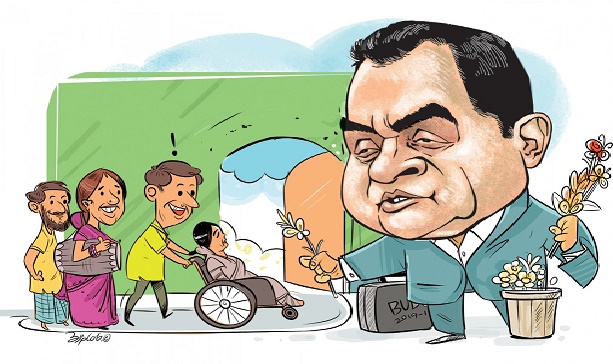

Next budget set to offer sweeteners to businesses

The government is set to offer a wide-range of tax relief for the businesses in the budget for the upcoming fiscal year (FY) to help the latter survive the Covid-19 pandemic onslaught.

The government has also decided to be practical as far as the fixation of the tax revenue target for the next fiscal year is concerned.

The target for tax revenue collection for upcoming FY is likely to be equivalent to the original target--- Tk. 3.30 trillion--- for the outgoing FY. This will be the first such incident in the history of the country's budget making.

The original target for current FY, however, has been revised downward to Tk 3.01 trillion following a sluggish trend in tax collection.

The National Board of Revenue (NBR) in upcoming fiscal may reduce the rates of penal tax and Advance Tax (AT) for manufacturing units and also relax the punitive measures for VAT evasion.

Sources said the rate of monthly interest on the amount of evaded VAT might be cut to 1.0 per cent from existing 2.0 per cent.

Businesses have long been demanding reduction of the monthly interest on the amount of evaded VAT as the same, in some cases, turns out to be more than the payable VAT.

Officials said it would be a major change in the VAT law. This will enable the businesses to pay back their evaded VAT easily, they added.

The rate of interest on evaded VAT remained unchanged since inception of the VAT law.

A number of manufacturing sectors including cement, ceramic, beverage etc may enjoy reduced rate of AT from upcoming FY, sources said.

The VAT wing of the NBR is likely to cut the AT by 1.0 percentage point, from 4.0 per cent to 3.0 per cent, for the manufacturing industries that import bulk raw materials.

Official sources said the NBR is likely to consider the manufacturers, that are dependent on imported raw materials, enjoy a concessionary rate of advance tax at import stage to resolve the complexities surrounding the VAT refund.

Advance tax at import stage is a refundable tax but businesses have long been protesting imposition of the tax as their significant amount of capital remained blocked in the VAT offices due to delay in the process of VAT refund.

Talking to the FE, a number of field officials also said the AT for manufacturers should be waived completely.

They found that the actual payable VAT for some manufacturing sub-sectors becomes negative after adjusting the refundable taxes.

"We have to spare time for processing the refund unnecessarily for this fiscal measure," said a VAT commissioner.

VAT officials said they would not change any fiscal measures for mobile phone users, bank depositors or pharmaceuticals sector.

The VAT-free ceiling at Tk 5.0 million for small and medium scale businesses would remain unchanged for FY 2021-22.

Officials said their budget meetings with the prime minister and finance minister had been completed and they were now working on the basis of their instructions.

However, the board would incorporate changes until the last moment if those comes from the high-ups.

A senior revenue board official said the government high-ups were not in favour of increasing any taxes for the next fiscal as the economy was already hit hard by the pandemic.

Editor & Publisher: S. M. Mesbah Uddin

Published by the Editor from House-45,

Road-3, Section-12, Pallabi, Mirpur

Dhaka-1216, Bangladesh

Call: +01713180024 & 0167 538 3357

News & Commercial Office :

Phone: 096 9612 7234 & 096 1175 5298

e-mail: financialpostbd@gmail.com

HAC & Marketing (Advertisement)

Call: 01616 521 297

e-mail: tdfpad@gmail.com