Nowadays, the question is which group of investors should get policy priority in terms of getting their back saved during the extremely down days in the stock market, especially after the pandemic bite.

Recent developments and opinions from each side appeared as nothing less than a confrontation of some institutional and foreign investors with unsophisticated retail investors on the street.

Floor price is not allowing individual scrips at the stock exchanges to go below a certain price level, and general investors are happy with that as they are not seeing capital erosion every morning.

Policymakers and the securities regulator have apparently stood by the emotional retail investors through carrying on and supporting the artificial price level retention mechanism since March this year – something rarely practiced in markets.

Meanwhile, foreign and some institutional portfolio investors, who need to liquidate positions in listed securities for their own need, are annoyed with the disruption that is against free market principles.

As they barely find buyers above the floor price, they are stuck with holdings and are facing problems.

Professor Shibli Rubayat-Ul-Islam, chairman of the Bangladesh Securities and Exchange Commission, has clearly announced on several recent occasions that the unusual mechanism is meant to tackle the emergency situation only, and it will not be lifted until there is a balance between supply and demand in stock market.

His commission, in alignment with other offices of the government and the central bank, is trying to inject banks' money to help the market. However, the result is yet to be visible enough and the floor price is also there.

Small individual investors are getting policy priority apparently, and regulators are saying that the market is dominated by retail investors – around 80 percent – and they should be saved first.

This is true, if we look at everyday transactions of securities in the two stock exchanges.

As institutional and foreign portfolio investors are mainly buy-and-hold-type investors. They tend to trade less frequently in the stock market where there is no alternative asset class like exchange-traded funds, derivatives, and not even an active secondary market for debt securities.

On the other hand, a large number of individual investors, who tend to trade more frequently for quicker gains, contribute the most to the stock exchange turnover every day.

But what is barely discussed is that retail investors hold less than one-fifth of the stock market securities, and experts are calling for a regulatory attention that the other groups of investors need.

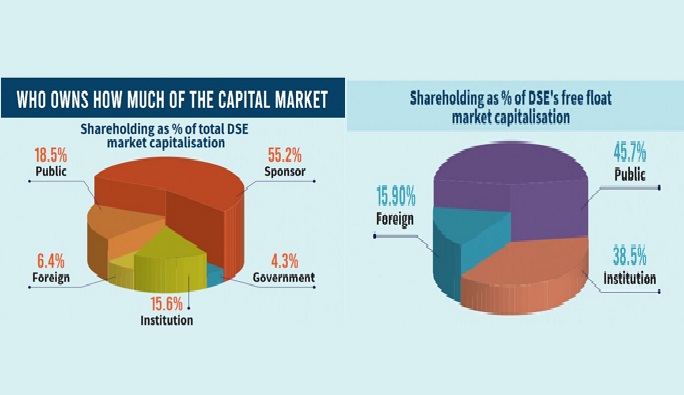

A recent compilation of the latest Dhaka Stock Exchange data on shareholding and market capitalisation of listed companies reveals that promoters and directors of listed companies own securities contributing over 55 percent of the DSE market capitalisation, while government holding accounts for 4.3 percent.

Institutional and foreign portfolio investors who literally need liquidity – sufficient buyers and sellers – in the market contribute 15.6 percent and 6.4 percent of the total market capitalisation respectively.

The two, who are fond of liquidity, together are bigger contributors among the shareholders who make the market of free-float securities – salable without prior declaration.

The government, company sponsors and directors, and large shareholders owning 10 percent of a company need to announce their buy and sell plan prior to ordering their broker, and their holding is excluded from free-float shares of a company.

On the other hand, the market of free float securities accounts for 41 percent of the total DSE market capitalization – Tk 1.54 lakh crore of the Tk2.6 lakh crore in total.

A compilation of DSE data by a top equity research team reveals that of the free float market capitalization, retail investors are the biggest single contributor, 45.7 percent, followed by local institutional investors with 38.5 percent and foreign investors with 15.9 percent.

Local institutional investors and foreign investors together surpass the total retail holding of free-float shares.

It is still a matter of policy priority whose problems among the two groups will be addressed first.

In a Saturday webinar to discuss stock market issues, bankers and business community leaders drew the BSEC chairman's attention in terms of not ignoring institutional and foreign investors' needs to save retail investors.

Bangladesh stock market has suffered record capital flight in the fiscal year 2019-20 in its history.

Of course no one wants mass people to lose. So, the million-dollar question on the street is – can floor price avert any catastrophe till the end of the show?

What do the other countries' experiences suggest?