Two banks have disbursed Tk 80 crore to three non-government organisations under the Tk 3,000 crore stimulus package that the government announced for the farmers, low-income people and small-time traders businesses three months back.

According to Bangladesh Bank data, Pubali Bank disbursed Tk 50 crore to Shakti Foundation on Sunday for disbursing loans among the people of the targeted groups.

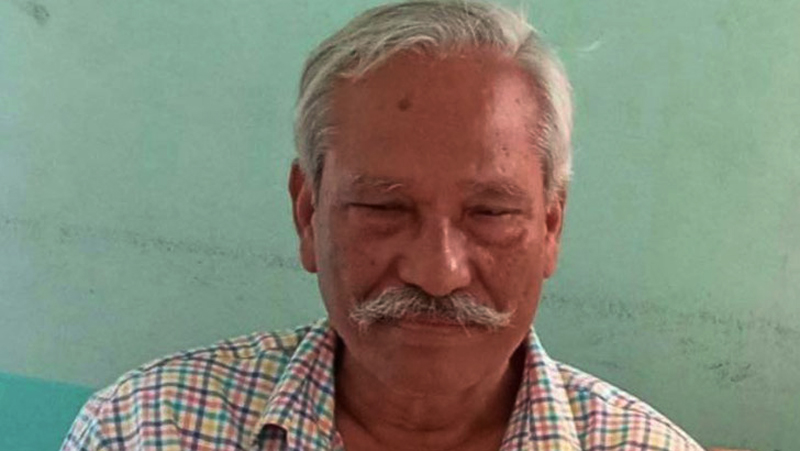

Pubali Bank managing director Md Abdul Halim Chowdhury said, ‘We disbursed the loans to the NGO this week and we have another plan for arranging another loan scheme for farmers with another large MFI [microfinance institution].’

Another two NGOs — Society for Social Service and Palli Mongal Kramosuchi — received Tk 30 crore in loans from The City Bank.

The bank also sanctioned another Tk 120 crore for the two MFIs— Tk 60 crore from each — under the refinance scheme.

The Bangladesh Bank launched a Tk 3,000-crore refinancing scheme for low-income people, including farmers and small-time traders, on April 20 keeping to a government announcement to assist marginalised people who were affected by the fallout of COVID-19 outbreak.

People of the target groups, however, have not yet received any loans.

A total 42 banks have signed participatory agreement with the central bank to disburse the loans and the banks have set targets to disburse Tk 2,552.25 crore under this package which set interest rate of the loans at 9 per cent.

So far, BB approved banks’ proposals to disburse Tk 314 crore to the NGOs.

The loans will be distributed through microcredit entities in order to ensure they reach the grassroots level.

From the NGOs, a single individual is supposed to get up to Tk 75,000 from the package, while the borrowing limit for a group of five individuals has been set at Tk 3 lakh.

NGOs’ lending limit to a single small entrepreneur has been set at Tk 10 lakh, while the limit is Tk 30 lakh for a joint project of a group of at least five members.

The borrowing capacity will rise proportionately with the increase in the number of members in the group.