The interest rate spread of non-bank financial institutions (NBFIs) experienced a significant drop of 40 per cent this July compared to the previous month, due to an increase in non-performing loans and lack of deposits.

Interest spread denotes the gap between the rates paid to depositors, and the rates imposed on borrowers.

Industry insiders say a decrease in interest rate signifies a decline in financial health of the sector. For NBFIs to operate effectively, it is recommended to maintain a minimum interest spread of 3% to ensure financial stability and sustainability.

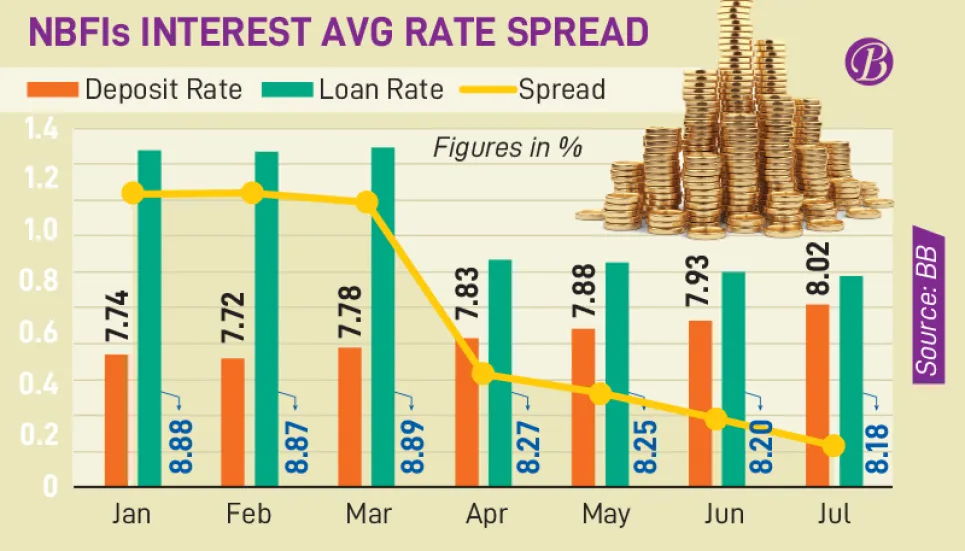

Central bank data shows that the NBFIs collected deposits at an average interest rate of 8.02 per cent in July, while the interest rate on loans stood at 8.18 per cent. The interest rate spread for NBFIs narrowed to 0.16, indicating that the sector is suffering from a lack of deposits.

NBFIs collected deposits at an average interest rate of 7.93 per cent in June, while they offered loans at an average interest rate of 8.20 per cent. So, the interest spread rate stood at 0.27 per cent in June.

An analysis of both months’ data show over 40 per cent decline in the spread.

From January to July, the interest rate spread of NBFIs has steadily declined. The figure was at 1.14 per cent in January, 1.15 per cent in February, 1.11 per cent in March, 0.44 per cent in April, 0.37 per cent in May, 0.27 per cent in June and 0.16 per cent in July.

Speaking to The Business Post, Industrial and Infrastructure Development Finance Company Ltd (IIDFC) Managing Director Md Golam Sarwar Bhuiyan said, “From July, the central bank started the ‘SMART’ rate.

“NBFIs are offering deposits with high interest compared to the previous months. As a result, the interest spread has dropped. Amount of deposits in the NBFI sector is less compared to the banking sector. But the amount of deposits is now increasing gradually.”

Policy Research Institute Executive Director Ahsan H Mansur said, “The decreased interest rate spread means the cost of funds for NBFIs has increased, as people do not trust the financial sector.

“These institutions are offering high interest against deposits to boost funds, causing the interest rate spread to decline.”

He added, “The NBFI sector is at a worse state than the banking sector. Their financial condition is weakening because they cannot get repayments from borrowers, causing the default loans to go up. NBFIs are unable to secure more deposits as well.

“There is no transparency in this sector. We have too many financial institutions in the country, and we do not need so many NBFIs.”