Bangladesh’s remittance inflow – which is already showing a steady decline – could continue on this downward trend in the coming months as banks have decided to lower the USD rate in foreign exchange houses from November 1, economists say.

This decision – taken by the Bangladesh Foreign Exchange Dealers’ Association (BAFEDA) and Association of Bankers, Bangladesh (ABB) on Sunday – will reduce overall earnings through remittance mobilisation, which in turn may discourage inflow from legal channels.

Banks will pay a maximum of Tk 107 per USD instead of Tk 107.50 to foreign exchange houses from the start of the next month. Meanwhile, exporters will get Tk 99.50 per USD from Monday, compared to the previous rate of Tk 99.

Experts and economists say the banks’ decision to impose multiple USD rates at the same time is illogical.

Zahid Hussain, former lead economist of World Bank Dhaka office, said, “Despite rising manpower exports, remittance inflow have fallen in recent months, and the new USD rates will cause the situation to deteriorate further.”

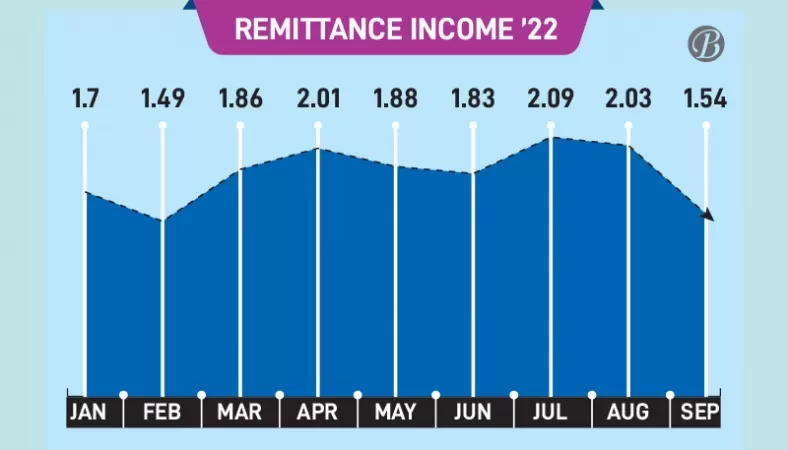

Bangladeshi expatriates sent $1.53 billion in September this year, down from $1.72 billion in the same month previous FY, show data from the Bangladesh Bank. Remittance inflow for the month of September also fell by 24.42 per cent compared to the previous month.

Hussain said, “Remittance inflow fell mainly due to the fixing of the USD rates. Only Bangladesh has multiple rates for a single foreign currency. The different rates for exporters, importers and remitters created volatility in the foreign exchange market.

“Bangladesh received only $1 billion in remittance during the first 20 days of October, which was nearly double at the same period in previous months. Why is BAFEDA lowering the USD rate for remittance collection at a time when the export earnings are not enough to cover import bills?”

Echoing the same, former governor of Bangladesh Bank Salehuddin Ahmed said, “The move to lower the USD rate for remitters would encourage more utilisation of the hundi system – an illegal cross border transaction.

“BAFEDA re-fixed the USD rates without carrying out any proper analysis of the forex market. The new rates will severely impact Bangladesh’s remittance earnings. BAFEDA should not have been allowed to set the USD rate. They are fixing rates as they wish, and it will not bring any positive impacts on the economy.”

After allowing the floating exchange rate in mid-September, BAFEDA asked authorised dealer banks to pay Tk 108 per USD to foreign exchange houses for mobilising remittance.

On September 27, the rate for remittance collection fell to Tk 107.50 per USD. Effective from October 1, the rate was another blow to the remittance earnings.

Before the fixing of the USD rates, different banks used to quote different rates for mobilising remittance from the foreign exchange houses. At that time, most of the banks – who had suffered from USD shortages – were offering up to Tk 115 per USD to the foreign exchange house.