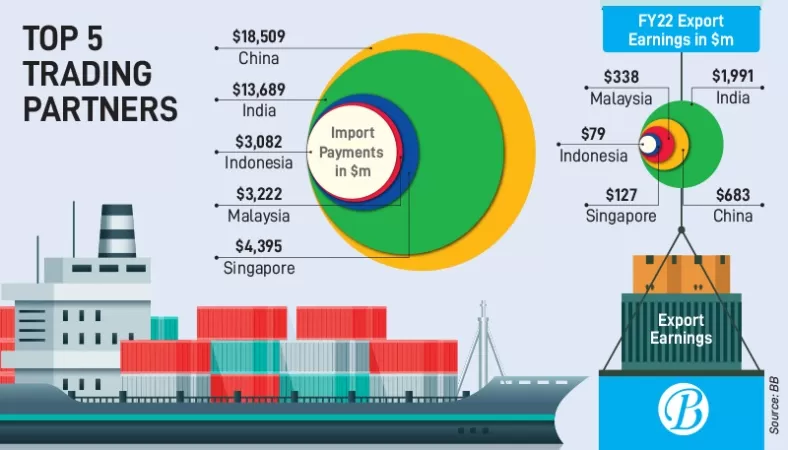

Nearly 52 per cent – the lion’s share – of Bangladesh’s imports are concentrated in China, India, Singapore, Malaysia and Indonesia, but only 6 per cent of the country’s export earnings come from these five nations, indicating a wide trade gap that should be mitigated.

Bangladesh import payments to these five nations stood at $42.89 billion in FY22, which was a significant chunk of the country’s total import payment of $82.49 billion that year, according to the Bangladesh Bank.

Moreover, Export Promotion Bureau (EPB) data show that Bangladesh’s total export earnings from those five countries are $3.22 billion, which was only 6.18 per cent of $52.08 billion – the total export earnings in FY22.

The trade gap among Bangladesh and those five countries was $39.68 billion in the last fiscal year.

Stakeholders say by grabbing a small share of the imports – mostly apparel goods – in China, India, Singapore, Malaysia and Indonesia, Bangladesh can reduce the trade gap and boost exports, as these five nations are home to huge populations with a good purchasing capacity.

They added that the reason behind such a large trade gap is Bangladesh’s dependency on the five nations for primary and intermediate raw materials imports – utilised by the local industries.

Besides, Bangladesh also imports a significant volume of consumer goods, including edible oil, from them. Industry insiders further point out that Bangladesh does not have the production capacity to make goods or diversified products that have demand in those countries.

China and India – top two sourcing destinations – are providing duty-free export facilities to Bangladesh, but the country is still unable to utilise this amenity.

‘Product diversification, efficiency key’

Speaking to The Business Post, several industry leaders and experts say it is difficult to boost exports in developing countries such as China, India, Indonesia and Malaysia, because Bangladesh is producing almost the same type of products that are made there.

Abdur Razzaque, chairman of Research and Policy Integration for Development (RAPID), said, “Bangladesh’s industries must work on boosting product diversification and efficiency.

“If we manage to increase foreign direct investments (FDI), the investors will bring in the technology and management skills necessary to diversify Bangladesh’s products and increase exports.”

Shah Md Sultan Uddin Iqbal, senior vice president of Bangladesh China Chamber of Commerce & Industry (BCCCI), said, “All stakeholders, including businessmen, should be brought together to initiate policy-making discussions as soon as possible.

“If we cannot diversify our exports, we cannot become a developed country.” Razzaque and Iqbal both recommended improving Bangladesh’s position in the Economic Complexity Index and better trade facilitation.

Bangladesh ranked 111 out of 136 countries in the Economic Complexity Index in 2020 – prepared by The Observatory of Economic Complexity (OEC). Bangladesh fell behind Afghanistan and Myanmar in the index.

China, top trade partner but little exports

Local manufacturing sectors import capital machinery, industrial raw material and intermediate goods from China – Bangladesh’s top sourcing destination. The country’s import payments to China reached $18.5 billion in the last FY.

But Bangladesh’s export earnings were only $683 million with the country, indicating a trade gap of $17.82 billion.

China announced duty-free benefits for 97 per cent of Bangladesh’s products in 2020. On August 7 this year, the Chinese foreign minister announced that Bangladesh had succeeded in increasing it to 99 per cent.

Besides, under the Asia Pacific Trade Agreement (APTA), Bangladesh has been enjoying duty-free benefits on 3,095 products to China. But not much progress has been made in increasing exports to that country.

Bangladesh’s main exports to China are apparel, leather, textiles, and chemicals.

Commenting on the matter, Shah Md Sultan Uddin Iqbal, senior vice president of BCCCI said, “Although China has given us trade facilities, our government has yet to start discussions on how to boost exports to that country.

“To increase exports in China, we need to increase our export basket. Besides, Chinese investors can be brought to our country and a separate EPZ can be established for them. Besides, local businesses have already found a great potential for sea fish exports to China.

India, a neighbour with trade opportunities

After China, Bangladesh imports the most goods from India. Bangladesh imported goods worth $13.69 billion from the country last FY, with the major import items being consumer goods, food grains and industrial raw material.

Like China, Bangladesh has a huge trade gap with India. The gap was $11.70 billion in the last fiscal year. However, Bangladesh’s exports to India are much higher compared to China. The export income from the neighbouring county almost reached $2 billion in FY22.

When asked about challenges against exports to India, industry leaders pointed out the non-tariff barrier.

Md Shahidullah Azim, vice president of Bangladesh Garment Manufacturers and Exporters Association (BGMEA) and also the managing director of Classic Fashion Concept, said, “Exports to India face a lot of complications at the border.

“Although China is a distant country, there are no problems in exporting goods there.”

Prof Mustafizur Rahman, distinguished fellow of Centre for Policy Dialogue (CPD), said, “India imports goods worth around $500 billion annually.

“Despite being a neighbour to India, we are unable to capture this market because we have no supply side capacity, low competitiveness and little trade facilitation. We need to improve these indicators.”

Singapore, Malaysia and Indonesia not far behind

Singapore was the third biggest souring destination of Bangladesh in the last FY. Bangladesh’s import payments to the developed country stood at $4.39 billion, while export income reached only $127 million.

Bangladesh mainly imported fossil fuel, iron and steel, chemical and electrical machineries from Singapore during the period. Bangladesh exported fish, crabs, apparel, vegetables and tea to the country as well.

Abdur Razzak, chairman of the Research and Policy Integration for Development (RAPID), said, “As Singapore is a developed country, Bangladesh does not have the capacity to produce products that are in demand in the country’s market.

“However, Bangladesh can put more focus on exporting ready-made garment products to Singapore.”

Malaysia is the fourth largest sourcing destination of Bangladesh. During the last fiscal year, Bangladesh imported goods worth $3.22 billion from that country, while the export earnings amounted to $338 million.

Bangladesh’s major imports from Malaysia are fossil fuel, palm oil, salt, rubber, and electric machinery. Meanwhile, Bangladesh’s key exports to that country were apparel and textile products.

Syed Almas Kabir, president of Bangladesh-Malaysia Chamber of Commerce and Industry (BMCCI), said, “We have been focusing on apparel exports till now. However, there is good demand in Malaysia for pharma, plastic, jute, IT, and ceramic products.

“If the government introduces clear incentives in this regard, it will help us boost exports to Malaysia.”

Kabir added, “Pran, Akij and Munnu Ceramics have shown interest in investing in the agro processing and ceramics sectors in Malaysia. This investment will increase the image of Bangladesh in the country.”

The BMCCI president called for continuing negotiations with Malaysia to reduce non-tariff barriers.

Indonesia is the fifth largest souring destination of Bangladesh, where import payment exceeded $3 billion in the last financial year. Meanwhile, the export income in FY22 from the country was a meager $78 million.

Bangladesh’s key imports from Malaysia are animal or vegetable fats, prepared edible fats, fossil fuel, salt, cotton, plastic, iron, and steel. Bangladesh exported apparel, textile, hydrogen peroxide and pharma products to that country during the period.

RAPID Chairman Abdur Razzak said, “Indonesia and Malaysia have large economies. Their domestic industries are capable of meeting their own needs. So, without stronger initiatives, it will be difficult to increase our exports to those countries.”