Bangladesh’s apparel exporters witnessed a 12.17 per cent decline in work orders during the March-June of 2022 when compared year-on-year, triggered by the Russia-Ukraine war which caused supply chain disruption and rising global inflation, leaving economies in severe crisis.

Speaking to The Business Post, a number of exporters expressed their concerns that they might face negative export growth during the September-November period.

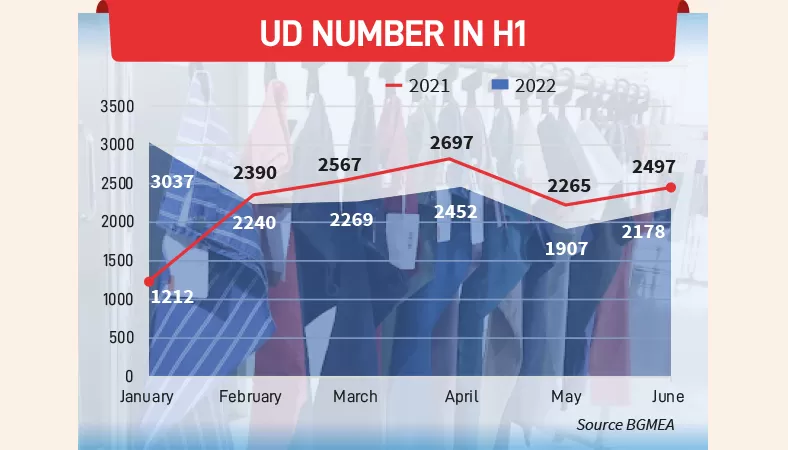

Data from the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) reveal that the number of Utilisation Declaration (UD) permission taken by exporters from the trade body declined from 10,026 in March-June of 2021 to 8,806 in the same period this year.

The trend of work orders inflow is defined by the number of UD permissions given by a relevant association. UD is a permission given to an exporter to import raw materials to execute any work order placed by an importer.

However, the number of UD permissions taken by exporters during January-June of 2022 rose by 3.33 per cent to 14,083, which were 13,628 during the same period last year.

The Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) too stated that the Utilisation Declaration (UD) permission given by the platform declined by 13 per cent – 15 per cent during the March-June period.

An alarming issue

Commenting on the issue, BGMEA President Faruque Hassan said, “This is an alarming issue for us, and also for the country.

“The decline in orders was caused by the war which created high inflation in our export destination countries, and appreciation of USD against their respective currencies. As a result, consumers’ purchase capacity in those countries dropped.”

He added, “For this reason, it will be tougher for us to continue the positive export growth, which in turn will severely impact our forex reserves.”

The US, European Union (EU) and UK are major export destination countries for the apparel sector, and around 82 per cent of earnings come from these countries. Due to the war, the EU and UK depreciated their currency against the USD.

Inflation across the Eurozone has soared to a fresh record of 8.6 per cent in June as Russia’s war in Ukraine added to the cost of living there.

In the US, the consumer price index rose 9.1 per cent compared to a year earlier in a broad-based advance, the largest gain since the end of 1981, Labor Department data showed on July 13.

To reduce inflation, these countries increase bank rates, which further reduced the consumers’ purchase capacity.

Exporters and economists blamed the ongoing Russia-Ukraine war as it created a global economic crisis by disrupting the supply chain of fuel, grains, and other commodity prices. As a result, global inflation rose to historic levels, decreasing people’s purchasing power.

As the peoples’ purchasing power decreased, the demand for consumer goods plummeted, causing buyers to place less work orders.

Fakir Kamruzzaman Nahid, managing director of Fakir Fashion, said, “We are navigating through a tough situation due to the war. Just before the war, I received work orders beyond my capacity. But my factory’s booking is now under 90 per cent of the capacity.”

Shahidullah Azim, managing director of Classic Fashion Concept, said, “July order situation is worse than May and June. We fear that the sector will likely suffer negative export growth from September to November.

“Currently, most of the factories are facing order shortages and continuing their operations while incurring losses. To avoid negative growth and big losses, we are focusing on man-made fibre based clothing and more diversification.”

Research and Policy Integration for Development (RAPID) Chairman Mohammad Abdur Razzaque said, “High inflation and the appreciation of the USD against Bangladesh’s export destinations’ currencies are responsible for the decline in RMG work orders.

“If Bangladesh can continue positive growth, it will be enough considering the ongoing situation.”

Md Khosru Chowdhury, Managing Director of Nipa Group, told The Business Post, “Most of my buyers have reduced their work orders, and are pressuring to reduce prices as well. They claimed that their sales have declined and a huge volume of clothes are still unsold.

“For this reason, I accepted work orders at rates under production costs, fulfilling only 40 per cent of our total capacity. Under the current circumstances, we and our buyers are sharing losses to survive.”

After the outbreak of Covid-19 in March 2020, the issuance of UD permissions dropped drastically to 520 in April the same year, compared to 2,090 in the same period 2021.

However, the sector made a comeback and recorded over 20 per cent growth to 29,849 UD permissions in 2021, compared to 24,714 in 2020. In FY22, export earnings from readymade garments rose by 35.47 per cent to $42.61 billion year-on-year.

Despite the current situation, the commerce ministry set the clothing sector’s FY23 export target at $47 billion, which is over 81.03 per cent of the total merchandise export income target.

Economist Razzaque said “If exports can be increased to non-traditional markets, especially India, Indonesia, the Middle East, Japan, China, and Korea, and if the export basket is diversified, Bangladesh would likely be able to meet the target.”