A consignment of knitwear items – exported by Chattogram-based BLP Warm Fashion to a US buyer in the third week of May – had got stuck at Singapore port, a container transshipment hub, for 21 days because the US-bound mother vessels did not have space.

After four failed tries, the shipment that was supposed to be delivered by 19 June, has been finally loaded onboard a vessel and is scheduled to be delivered on 7 July – 18 days later than the original date. Now the exporter might not get its payment on time from the buyer because of this long shipping delay caused by vessel shortages.

Mohammed Mohiuddin, chairman of the BLP Warm Fashion Limited said mother vessels coming from China and Korea for the US and Europe routes via Port Klang were fully loaded with containers. That is why their containers could not be loaded into the scheduled vessels on time.

"We have not got our payment from the US buyer as the consignment has not been delivered yet. Besides, we are incurring big losses because of the delay in shipment," he added.

Like BLP Warm Fashion Limited, for many Bangladeshi shippers it is now a mad rush to secure containers from any available shipping services owing to container and vessel capacity shortages at transshipment ports – Port Klang in Malaysia, and the ports in Singapore and Colombo, Sri Lanka.

Experts have attributed the ongoing crises to a surge in demand after months of blank sailings following the rebooting of businesses globally, slow delivery of goods from transshipment ports, and port workers going out of service after getting infected with Covid-19.

The number of Bangladeshi goods carrying containers, which have now remained stuck in three transshipment ports, is over 30,000 TEUs (Twenty-foot equivalent unit), according to different shipping agents. However, the Bangladesh Shipping Agents Association could not confirm the number.

There is no data on the amount of losses that Bangladeshi exporters and importers are incurring from the shipping holdup.

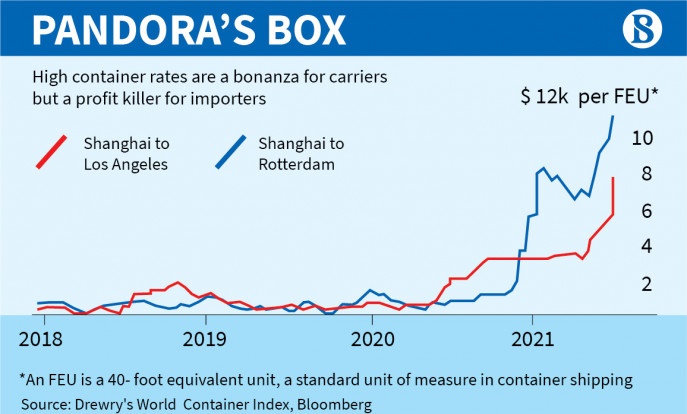

There still are not enough steel boxes to meet the demand on the most sought-after routes, particularly from Asia to the US. With Europe's reopenings gathering pace, the strains may get magnified, Bloomberg reported.

While shipping lines have deployed all their resources and have ordered hundreds of thousands of new containers, those are coming online only slowly and will not ease the current capacity crunch very much if ports cannot handle the extra volume, the news portal added.

As there is no deep seaport in Bangladesh, mother vessels cannot come to the Chattogram port directly. Therefore, Bangladesh's export-import goods need to change vessels at transshipment ports in Singapore, Malaysia and Sri Lanka.

The delay has also hit Bangladeshi importers hard as raw materials meant for industrial production are getting stuck at the ports, causing losses, businesses say.

There have been uncertainties regarding the arrival of imported cargo containers at the Chattogram Port owing to container congestion, and shortage of space on mother vessels and empty containers at transshipment ports in Sri Lanka, Singapore and Malaysia.

A Matin Chowdhury, managing director of Rahim Textile Mills Ltd, told The Business Standard, "A consignment of raw cotton for my factory had been stuck at the Colombo port for an additional 30 days. Those containers, which were supposed to reach the Chattogram port towards the end of April, are now waiting at the outer anchorage."

Shipping companies said Bangladesh-bound containers see a delay of around 45 days because of a massive gridlock at the Colombo port, while shipments get delayed by two-three weeks at Singapore port and Malaysia's Port Klang.

Ajmir Hossain Chowdhury, assistant general manager at Mediterranean Shipping Company, said, "There is a delay of over 45 days at the Colombo port. Many feeder operators had operated small vessels instead of large vessels during the pandemic, leading to the crisis at the port."

"Production is being hampered as many consignments of imported raw materials have been stuck at transshipment ports," said Syed Mohammed Tanvir, managing director Pacific Jeans Ltd.

"The shipment delay increases lead time. That is why the RMG sector has to face big losses as buyers demand air freight for quick delivery," he also said.

"As mother vessels do not come directly to our port, we have to depend on transshipment ports. The present crisis is taking a heavy toll on Bangladesh export-import business," said Tanvir, also vice-president of Chattogram Chamber of Commerce and Industry.

Mohammad Ali Khokon, president of Bangladesh Textile Mills Association, said almost every textile entrepreneur is facing the same challenges, while they have the pressure of additional work orders.